Recent calculations reveal that mining cryptocurrencies need a lot of energy than the energy that will be required to mine precious metals like gold, copper, or platinum.

Max Krause, a researcher from the Oak Ridge Institute for Science and Education, jotted down the figures along with an Environmental Engineer, Thabet Toloymat. Thabet was working in the US in Cincinnati, Ohio.

The duo tried to arrive at an estimate about the average amount of energy that is consumed to generate cryptocurrency worth $1. The result is that crafting Bitcoin, Litecoin, Ethereum, and Monero will consume the same amount of energy like mining copper, gold, platinum, and other rare earth oxides.

Their research paper was published in Nature this week. The report reveals, “From 1 January 2016 to 30 June 2018, we have estimated that mining Bitcoin, Ethereum, Litecoin, and Monero has consumed an average of 17, 7, 7 and 14 MJ (MegaJoules) to generate $1, respectively.”

On comparing the conventional mining of copper, aluminum, platinum, gold, and rare earth oxides, it was noted that it required 122 MJ for aluminum, 4 MJ for copper, 5 MJ for gold and 7 MJ for platinum, and for mining cryptocurrency worth $1 it takes about 9 MJ. Thus, indicating that except for the equivalent energy needed for aluminum, cryptocurrency required more power than that is required for conventional mining of metals like copper, platinum, gold, and rare earth oxides.

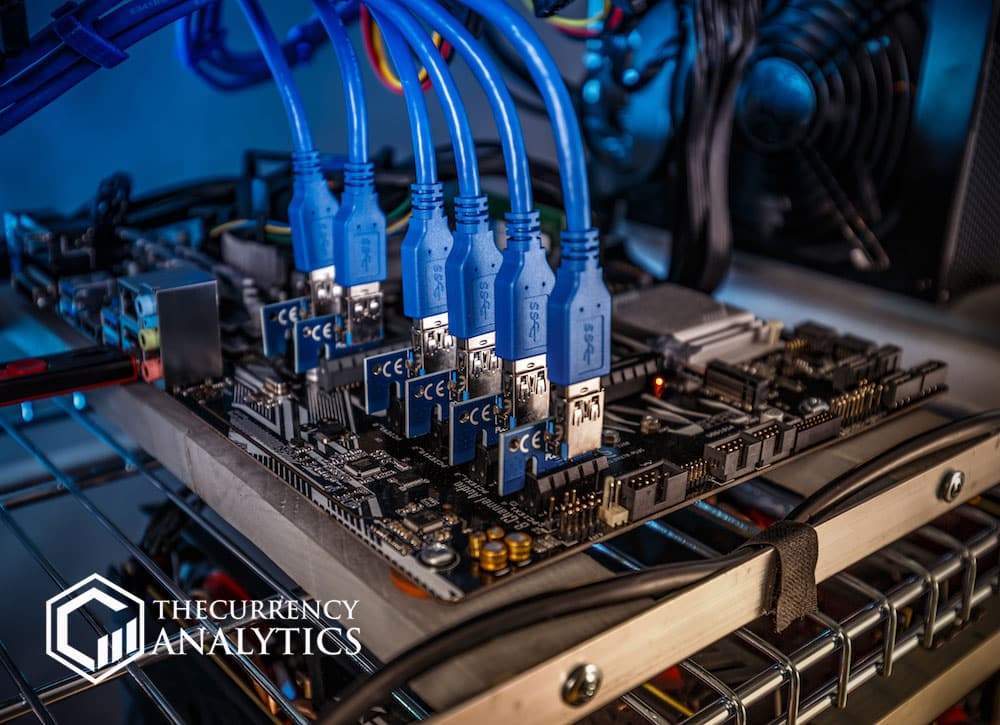

The mining process is expensive because the mining process involves the rigs of software and hardware that compete with each other to add blocks to the blockchain of the cryptocurrency in the digital ledger that displays the transactions publically for that particular block.

These blocks store the details of every transaction, and this is why they are heavily sought after. The miners are rewarded with the digital currency each time. For every transaction, the validity is verified for the addition of further blocks.

Transactions with the potential to be added to the block are held in the transaction pool. The miners take up a bunch of these transactions, and they assemble them in a candidate block into a package to add it to the currency’s blockchain. The hash value is used to verify the value of the previous block. By using hash value and due verification, the block is added to blocks forming the blockchain for the currency.

The digital ledger thus established is used for reference by the miners who construct the blocks by performing the verifications for the target value in the currency network. The blocks are added if they meet the required eligibility requirements.

The whole of the block hashing process consumes a lot of energy, and the miners are competing with each other to create a block that is acceptable to the distributed ledger system. Miners focus on making money by crafting blocks. So, the costs outweigh the reward with mining. The last of the Bitcoin will be mined in 2140 per an estimate.

Get the latest Crypto & Blockchain News in your inbox.