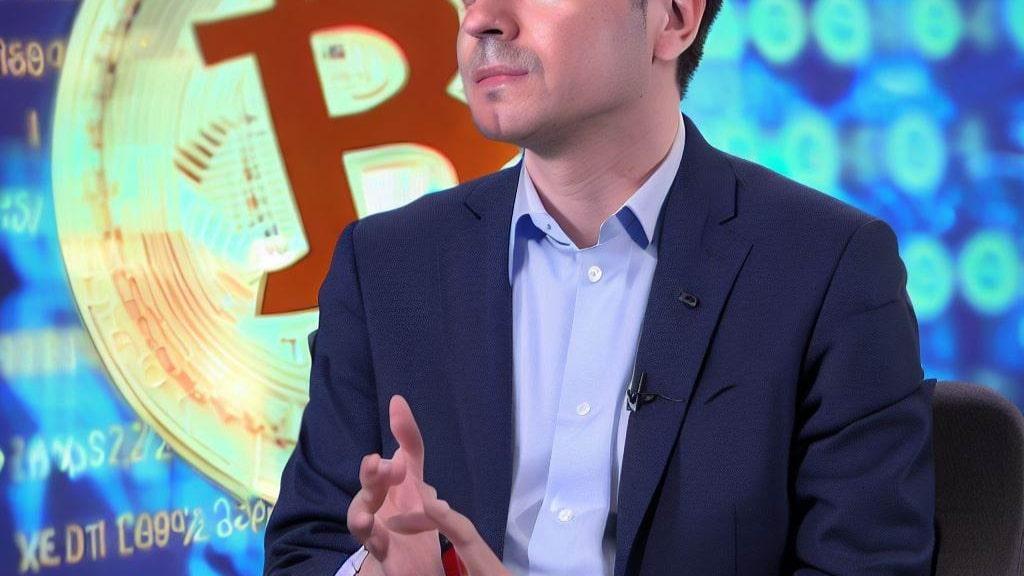

In a recent appearance on CNBC’s “Squawk Box,” Tom Lee, co-founder of Fundstrat, embarked on a thought-provoking analysis of Bitcoin’s future trajectory. His insights provided a comprehensive view of the key elements that could sway Bitcoin’s price trajectory and influence its role in the evolving financial landscape. At the heart of Lee’s projections lies a significant event – the potential approval of a Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC). This hypothetical green light, according to Lee, has the potential to ignite a surge that could push Bitcoin’s value beyond the $150,000 mark, potentially nearing $180,000. Nevertheless, Lee underscores that this optimistic projection hinges on the SEC’s verdict, making it a pivotal juncture for the crypto industry.

Bitcoin ETFs: A Global Landscape with U.S. Impact

Although Bitcoin ETFs have already established their presence on the international stage, obtaining recognition in various regions, a regulatory nod from the SEC would signify a seismic shift for the domestic cryptocurrency environment. The United States, renowned for its market-moving influence, could undergo a notable transformation with the introduction of a Bitcoin ETF. This development not only has the potential to bolster investor confidence but also solidify Bitcoin’s position in the mainstream financial realm.

Lee’s Insight into Cryptocurrencies and the Monetary Landscape

Delving deeper, Tom Lee emphasized the intricate interplay between cryptocurrencies and the broader monetary landscape. He posited that a potential stabilization in inflation rates could pave the way for a more accommodative financial environment. This shift might, in turn, incentivize central banks to loosen their grip on the traditional financial system, creating an advantageous backdrop for the growth of cryptocurrencies. In this scenario, Bitcoin could emerge as a prominent contender, leveraging its narrative as a store of value.

Navigating the Trajectory of Inflation Trends

Zooming out to survey the broader financial terrain, Lee shared his perspective on the oscillations of recent inflation trends. He noted that the current core inflation rate, resting at 0.16%, is largely anchored by robust figures within the housing sector. However, Lee anticipates these currents to gradually wane, projecting that inflation could dip below the 2% mark by the middle of the upcoming year. If this projection comes to fruition, it could impact investment strategies across diverse asset classes, including cryptocurrencies such as Bitcoin.

Bitcoin’s Journey: Peaks, Crashes, and Recovery

Bitcoin’s recent journey has been characterized by remarkable highs followed by subsequent recoveries. After reaching its peak at over $69,000 in late November 2021, the cryptocurrency experienced a significant crash. However, it managed to regain its footing, partly attributed to investment heavyweight BlackRock entering the ETF arena. Despite this rally, Bitcoin’s upward momentum has momentarily halted around the $30,000 level. The volatile nature of the cryptocurrency market, exemplified by Bitcoin’s rollercoaster ride, underscores the necessity for a nuanced approach when charting its trajectory.

In Conclusion: Decisive Moments Mold the Path Forward

Tom Lee’s analysis serves as a reminder of the pivotal moments that possess the potential to shape Bitcoin’s journey. The impending SEC decision regarding a Bitcoin ETF approval stands as a milestone that could redefine the cryptocurrency landscape. The intricate dance between cryptocurrencies and broader monetary trends highlights the dynamic nature of this emerging financial realm. As Bitcoin navigates its path, characterized by peaks, crashes, and recoveries, the involvement of influential players and regulatory determinations continue to exert significant influence. In this ever-evolving landscape, the significance of each twist and turn cannot be underestimated.

Get the latest Crypto & Blockchain News in your inbox.