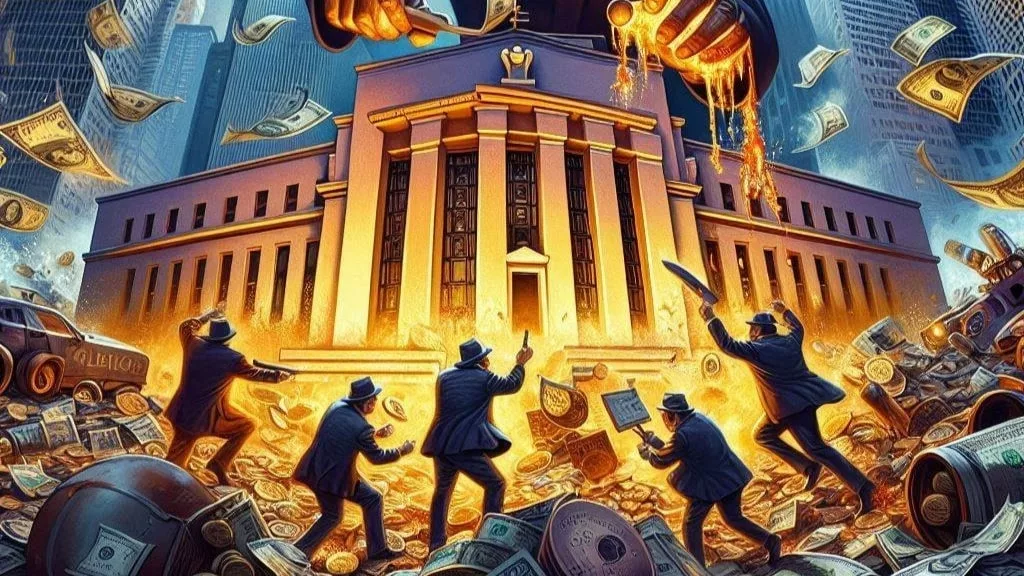

Cardano’s luminary founder, Charles Hoskinson, has launched a scathing tirade against the US Federal Reserve, accusing it of corruption amidst a storm of controversy. Hoskinson’s vociferous condemnation echoes the sentiments of Custodia Bank CEO Caitlin Long, as both figures shine a harsh spotlight on the alleged discriminatory practices of the Federal Reserve.

Hoskinson’s Allegations Against the US Federal Reserve At the epicenter of the storm is Hoskinson’s damning accusation of corruption against the US Federal Reserve. His outcry reverberated across digital platforms as he implored voters to “vote crypto” in the forthcoming 2024 elections, warning of dire consequences should the status quo prevail. His rallying cry was punctuated with a stark declaration: “Remember in 2024 to vote crypto, or else you get more of this corruption.”

These incendiary remarks were catalyzed by Long’s incisive critique of the Federal Reserve’s purported preferential treatment towards select banking institutions with ties to former Fed officials. Long’s scathing indictment laid bare what she perceived as glaring disparities in the Federal Reserve’s regulatory oversight, raising troubling questions about its integrity and impartiality.

The Root of the Controversy Central to the controversy is the Federal Reserve’s alleged favoritism towards certain banks, exemplified by recent developments involving Connecticut-based fintech bank Numisma. Despite being a non-FDIC-insured, non-federally regulated entity, Numisma received conditional approval for access to a Federal Reserve master account, a privilege previously denied to similar institutions like Custodia Bank.

Eleanor Terrett, a prominent Fox journalist, further illuminated the contentious issue by shedding light on Numisma’s connections to former Fed officials, particularly former Fed Vice Chairman Randy Quarles. This revelation added fuel to the fire, intensifying scrutiny on the Federal Reserve’s regulatory practices and casting doubt on its commitment to fair and equitable oversight.

The Double Standard Dilemma Long underscored the apparent double standard inherent in the Federal Reserve’s decision-making process, citing the stark disparity between the treatment of Custodia Bank and Numisma. Despite possessing similar regulatory structures, Numisma received a coveted pass from the Federal Reserve, prompting Long to question the underlying motives behind this disparity.

John Deaton Enters the Fray As the controversy escalates, John Deaton, a prominent proponent of XRP and esteemed legal practitioner, has joined the chorus of voices decrying the Federal Reserve’s alleged malfeasance. Deaton minced no words in denouncing what he perceives as systemic corruption within federal regulatory agencies, likening the current era to a dark chapter in history marked by institutionalized malpractice.

Deaton’s impassioned plea for legislative reform underscores the urgency of addressing systemic flaws within regulatory bodies, particularly the phenomenon of the “revolving door” between government agencies and the industries they oversee. His proposed legislative measures seek to mitigate the risk of regulatory capture and restore public trust in the integrity of regulatory institutions.

Looking Ahead: Implications and Remedial Measures As the dust settles on this whirlwind of controversy, the implications reverberate far beyond the confines of the cryptocurrency community, casting a pall over the regulatory landscape and financial institutions alike. The need for robust oversight and accountability has never been more apparent, as stakeholders grapple with the fallout from these explosive allegations.

In the wake of these revelations, the onus lies on policymakers and legislators to enact meaningful reforms aimed at restoring public trust in regulatory institutions and safeguarding the integrity of financial markets. Only through concerted action and unwavering commitment to transparency and accountability can the specter of corruption be vanquished, paving the way for a fairer, more equitable future for all.

Get the latest Crypto & Blockchain News in your inbox.