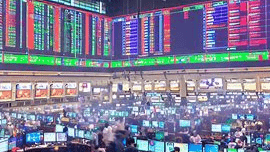

Australia’s stock market experienced a day of diverse outcomes as various sectors displayed contrasting performances. Notably, gains in the Healthcare, IT, and Energy sectors propelled shares higher, while select stocks encountered losses, resulting in a mixed overall trading day. The S&P/ASX 200 index, a benchmark indicator of the Australian stock market, exhibited modest movement, reflecting a range of trends across different companies and industries.

At the close of trading in Sydney, the S&P/ASX 200 index managed to eke out a minor gain of 0.03%. The market’s performance for the day was characterized by the interplay of sector-specific developments, contributing to both upward and downward price movements.

Sectoral Gains Leading the Way

The Healthcare, IT, and Energy sectors emerged as the frontrunners, driving the positive momentum in the market. Their collective performance contributed to the slight increase in the S&P/ASX 200 index. The market witnessed upward movements in shares of various companies operating within these sectors, reflecting investor interest and confidence in their prospects.

Top Performers of the Session

Among the standout performers on the S&P/ASX 200 index were James Hardie Industries PLC (ASX:JHX), which observed a remarkable surge of 14.38%, adding 5.86 points to trade at 46.62 at the close. Reece Ltd (ASX:REH) demonstrated a notable gain of 3.93%, increasing by 0.76 points to end at 20.10. Additionally, Reliance Worldwide Corporation Ltd (ASX:RWC) experienced a positive trajectory, registering a gain of 2.84% or 0.12 points, reaching 4.34 by the close of late trading.

Session’s Laggards

Conversely, some stocks faced challenges during the trading session, contributing to a mixed overall market performance. Mesoblast Ltd (ASX:MSB) experienced a decline of 8.54%, losing 0.04 points and concluding at 0.38. Zip Co Ltd (ASX:ZIP) witnessed a decline of 5.81%, with shares decreasing by 0.03 points to reach 0.41. Charter Hall Long WALE REIT (ASX:CLW) also saw a decrease, with shares dropping by 5.71% or 0.23 points, settling at 3.80.

Market Dynamics and Key Figures

The Sydney Stock Exchange depicted an imbalance between falling and advancing stocks, with 701 stocks declining against 502 advancing ones, while 451 stocks remained unchanged. Notably, the market’s response was reflected in the trading day’s significant stock price movements.

Shares in James Hardie Industries PLC (ASX:JHX) achieved a notable milestone, rising to a 52-week high and exhibiting a remarkable 14.38% increase to 46.62. Conversely, Mesoblast Ltd (ASX:MSB) experienced a downturn, reaching all-time lows with an 8.54% drop to 0.38. Reece Ltd (ASX:REH) managed to reach a 52-week high, marking a 3.93% increase to 20.10. Charter Hall Long WALE REIT (ASX:CLW) faced challenges, reaching a 3-year low and experiencing a decline of 5.71% to 3.80.

Market volatility, as measured by the S&P/ASX 200 VIX, witnessed a decrease of 1.07%, settling at 11.68, reflecting a certain level of market stability.

Commodities and Currency Movements

In commodities trading, Gold Futures for December delivery experienced a minor decline of 0.15%, equating to a decrease of 3.00 points, reaching $1,967.00 per troy ounce. Crude oil for delivery in September faced a decline of 0.72%, resulting in a decrease of 0.59 points to reach $81.35 per barrel. Similarly, the October Brent oil contract experienced a decrease of 0.73%, translating to a decline of 0.62 points, trading at $84.72 per barrel.

Currency markets exhibited mixed movements, with AUD/USD remaining unchanged at 0.65, while AUD/JPY experienced a decline of 0.30% to 93.38. Meanwhile, the US Dollar Index Futures saw an increase of 0.29%, settling at 102.16.

In conclusion, Australia’s stock market demonstrated a day of mixed fortunes, with sectoral gains in Healthcare, IT, and Energy offsetting some stock declines. The market’s overall movement reflected a complex interplay of factors, including sectoral dynamics, global economic conditions, and commodities and currency fluctuations. This nuanced landscape underscores the need for investors to remain vigilant, analyze various factors, and make informed decisions in an evolving market environment.

Get the latest Crypto & Blockchain News in your inbox.