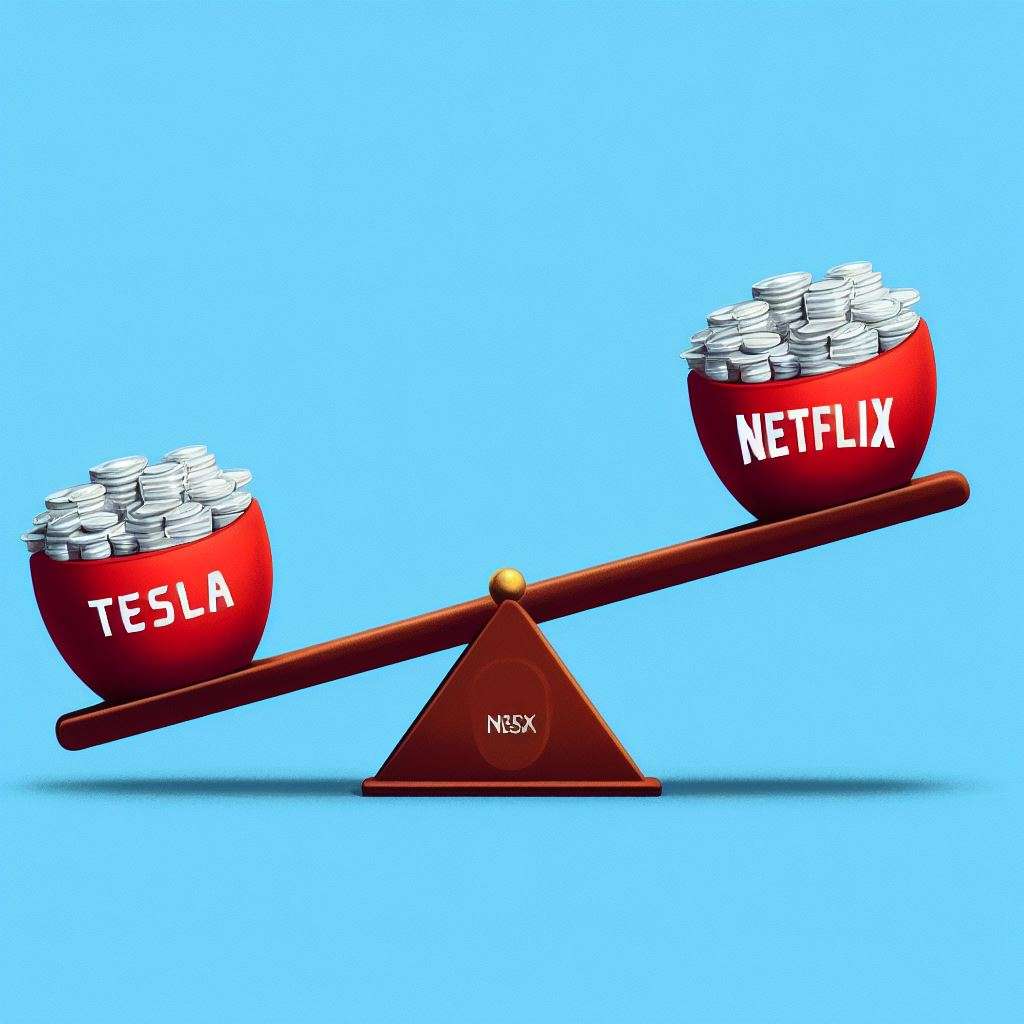

In the ever-shifting landscape of the U.S. stock market, today’s pre-market activity tells a tale of contrasting fortunes for two industry giants. As the bellwether stock index futures experienced a modest 0.2% decline, Tesla and Netflix emerged as the stars of the show, each charting a distinct course.

Tesla’s Margin Hiccup

Tesla, the world’s most valuable car company, faced a 4.6% tumble in pre-market trading, and the culprit behind this fall was a recent report highlighting a drop in gross margins during the third quarter. The news sent ripples through the financial markets and left investors pondering the implications.

The electric vehicle pioneer has long been at the forefront of innovation, championing sustainable transportation and carving a unique niche in the automotive industry. However, the slight dip in gross margins during Q3 may have raised eyebrows. It’s worth noting that the automotive industry is highly capital-intensive, and even a slight blip in margins can have a notable impact on a company’s bottom line.

Yet, this is not the first challenge Tesla has faced, and history shows that the company has an uncanny knack for surmounting obstacles. Tesla’s charismatic CEO, Elon Musk, is known for his audacious vision and the ability to steer his company through turbulent waters. The world watches with bated breath to see how Tesla will navigate this latest hurdle.

Netflix’s Spectacular Surge

On the flip side of the coin, Netflix, the streaming giant, has been basking in the glow of success. In pre-market trading, Netflix shares surged by a remarkable 13%, marking a significant uptick in the company’s value.

The cause behind this meteoric rise was a phenomenal increase in subscriber numbers in several key markets during the third quarter. As the world continued to grapple with the ongoing digital revolution, Netflix reaped the rewards of a surging demand for its content.

Netflix, once known as a disruptor in the entertainment industry, has solidified its position as a global powerhouse. With an extensive library of original content and a user-friendly interface, the streaming service has become an integral part of countless households around the world.

The streaming wars, which were initially a fierce battleground, have gradually settled into a state of coexistence, with various platforms catering to different niches. Netflix’s remarkable subscriber growth shows that it’s successfully adapting to changing consumer preferences and retaining its competitive edge.

Implications for Investors

For investors, these two divergent stories offer a glimpse into the unpredictability of the stock market. It’s a reminder that even the most dominant companies can face challenges, and seemingly unstoppable trends can be disrupted.

Tesla’s margin hiccup underscores the importance of monitoring financial health, especially in capital-intensive industries. It’s a lesson in the delicate balance between innovation and profitability. As Tesla continues to expand and diversify, investors will keep a close eye on how it addresses its margin concerns.

On the other hand, Netflix’s triumphant rise showcases the value of adapting to evolving market dynamics. The company’s ability to attract and retain subscribers demonstrates the importance of content quality and user experience in the digital age. For investors, this could be a signal that there’s still plenty of growth left in the streaming industry.

Looking Ahead

As the trading day unfolds, investors will be closely watching how these two industry giants perform. The stock market is a dynamic arena where fortunes can change in an instant, making it a thrilling yet unpredictable ride for investors.

Tesla’s response to its margin challenges and Netflix’s continued subscriber growth will be closely watched. But in the world of investing, one thing remains certain: past performance is not indicative of future results. The financial markets are a reflection of a complex web of factors, from economic indicators to global events, and they can sway in unexpected directions.

In a landscape where the only constant is change, investors must stay informed, adapt, and make decisions that align with their financial goals and risk tolerance. The story of Tesla and Netflix is just one chapter in the ever-evolving narrative of the stock market, and there are many more twists and turns to come.

Get the latest Crypto & Blockchain News in your inbox.