Circle’s CEO is gearing up for everything ranging from the USD through shares in public companies. With their random deal spree, they are preparing to be able to operate on the blockchain one day.

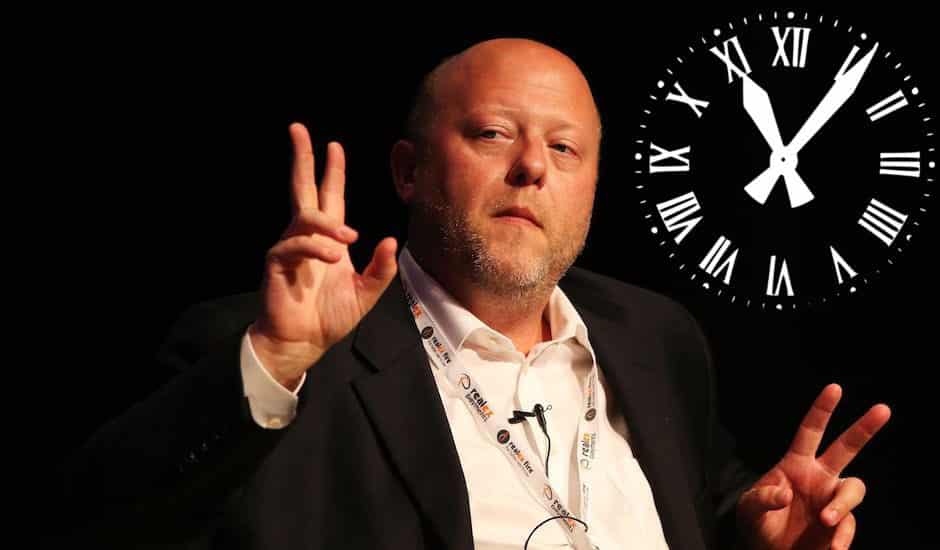

Jeremy Allaire, CEO of Circle, stated, “It will make the web look like a cute experiment in 10 to 15 years.”

About 5 years ago, Circle started off as a peer-to-peer payment company. Now, they are buying exchanges and startups with a bet on cryptocurrency. Notwithstanding the current year price slump, the crypto economy is here to stay.

In a bullish hope that the cryptocurrency fundraising will become mainstream, the Goldman Sachs backed start-up bought SeedInvest. Seedinvest is a licensed broker-dealer.

They also acquired Poloniex, the cryptocurrency exchange earlier in 2018 and they launched the “stable coin.”

CEO Jeremy Allaire stated that his step towards SeedInvest is a random bet on crypto. The acquisition of the equity fundraising startup is a real bet on crypto because the startup did not have anything to do with crypto until late. SeedInvest did not even seem a fit for Circle.

Allaire stated to the CNBC at the Security Token Academy conference in Manhattan that “If we zoom out, there is going to be tokenization of everything,”

There is a tricky timing to Allaire’s bet on cryptocurrency. This is because the buying of SeedInvest came within months of Circle buying Polenix and went ahead introducing its own stable coin. The initial coin offering in the past year increased the market cap of cryptocurrency to $816 billion. However, the value of these crypto-coins went down this year by half. While it is true that “Eventually the market places will have tens of thousands, if not hundreds or thousands of tokenized assets” the circle acquisitions are licensed and ready to go. The timing is tricky indeed.

The crowdfunding strategy of seed invest is a “Cousin” to how crypto companies raise money by using ICOs. Fellow investors are connected to startups looking for funding online. The broker-dealer license of this New York-based company is the key reason for the deal; however, the same needs to be approved by several US regulatory bodies.

Despite several ICOs working the pump and dump way, the retail interest continues to linger, and with regulation, the crypto industry is here to stay.

Rather than applying for its own license, Circle decided to partner up with a regulated company like SeedInvest.

Ryan Feit, CEO of SeedInvest stated: “We are chasing a similar vision in altering the way businesses raise funds.” He sits on the board of the Fintech committee of FINRA. The brokerage industry regulated stated that “It is a different form of empowering companies to raise money, and indeed an alternative form of assets for investors.”

Get the latest Crypto & Blockchain News in your inbox.