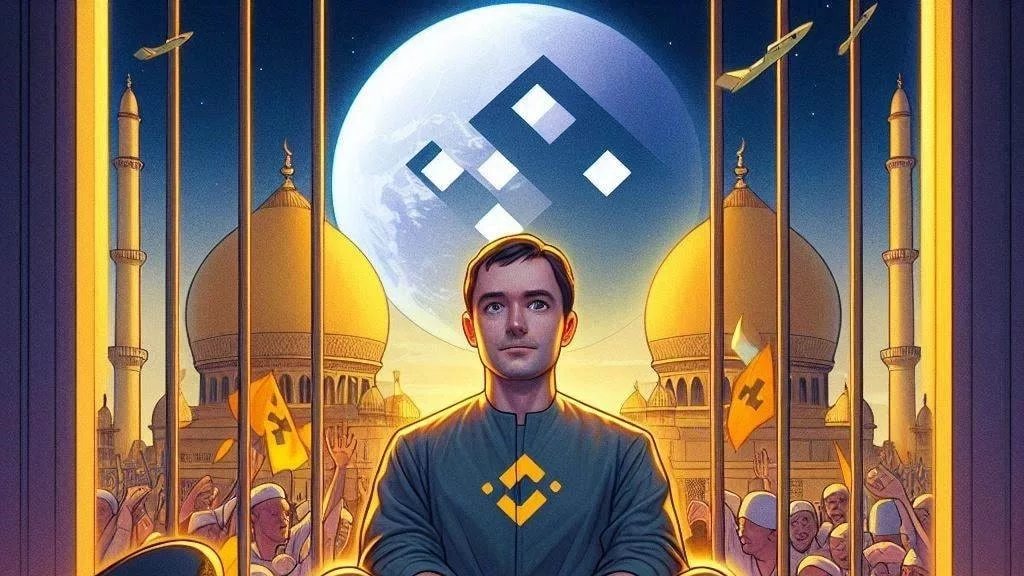

Binance CEO Richard Teng has made a fervent appeal to the U.S. government and international organizations to intervene in the case of Tigran Gambaryan, a senior executive at the prominent cryptocurrency exchange. Gambaryan, a U.S. citizen, has been held in Nigeria for six months under what Binance deems as unjust circumstances, prompting a call for urgent political action.

Richard Teng’s recent statement sheds light on the dire situation facing Tigran Gambaryan. According to Teng, Gambaryan’s health has significantly deteriorated due to a lack of medical care and inadequate legal representation. The Binance executive has been suffering from a herniated disc, which has left him in severe pain and unable to walk. Despite a court order demanding his medical records, Nigerian authorities have allegedly ignored this request, exacerbating Gambaryan’s condition.

“Tigran’s physical and mental health has deteriorated rapidly,” Teng stated. “He is in excruciating pain and unable to walk. The Nigerian government’s refusal to provide basic medical necessities, including a wheelchair, is both inhumane and unacceptable.”

Gambaryan’s detention has been surrounded by controversy, with Binance accusing the Nigerian government of using baseless allegations to justify his imprisonment. The company asserts that Gambaryan’s detention is linked to unfounded claims that Binance is responsible for Nigeria’s economic struggles, including the steep decline in the value of the Naira.

Binance has been accused of contributing to Nigeria’s financial woes, particularly the sharp fall of the Naira currency. However, Richard Teng counters these claims, asserting that Binance’s operations in Nigeria are relatively minor compared to the broader economic challenges facing the country. Teng emphasized that the issues with the Naira are a result of broader macroeconomic factors beyond Binance’s influence.

“There is no basis for imprisoning an innocent employee in relation to allegations against Binance,” Teng asserted. “We have resolved similar issues amicably in various countries, including the United States, Thailand, Brazil, and India, without resorting to harm against our staff.”

Binance’s call for intervention is not just about securing Gambaryan’s release but also about addressing what it views as unjust detention practices by the Nigerian government. The company has urged global citizens and organizations to support their cause, advocating for Gambaryan’s freedom and condemning what they describe as Nigeria’s unjust detention practices.

In a parallel development within the cryptocurrency sphere, Ripple whales have been notably active, purchasing large quantities of XRP tokens. Over the past 24 hours, whales have acquired more than 50 million XRP tokens, equivalent to approximately $30 million.

The influx of whale investment could be a positive indicator for XRP’s future value. Increased whale accumulation often signals confidence in an asset’s prospects and can lead to a reduced supply on the market, potentially driving up the price if demand remains constant or increases.

The recent legal developments involving Ripple and the U.S. Securities and Exchange Commission (SEC) have also played a role in shaping market sentiment. On August 7, a U.S. judge ruled that Ripple must pay a $125 million fine for violations related to securities laws. While this amount is a significant reduction from the $2 billion originally sought by the SEC, it was still seen as a major win for Ripple. The decision caused XRP’s price to briefly surge to $0.64, though it has since experienced volatility, settling around $0.58.

Analysts are divided on whether XRP is poised for a major price movement. Some suggest that a significant breakout could be imminent based on technical indicators. For example, the Bollinger Bands—used to measure market volatility—have tightened, signaling that a major price movement may be on the horizon.

Technical analysis tools have shown mixed signals for XRP. The Bollinger Bands have narrowed, suggesting that XRP could be poised for a substantial price shift. Analysts have observed similar patterns in the past that led to dramatic price increases. Furthermore, some experts, like DustyBC, predict that XRP could rise above $2 if it breaks out of a flag pattern formed over the past three years.

However, market sentiment remains cautious. Despite increased buying pressure and whale transactions, XRP’s social volume and weighted sentiment have recently dipped, reflecting a decline in its popularity and investor confidence. Additionally, indicators such as the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI) suggest that XRP may face delays before a potential breakout.

Binance’s plea for international intervention highlights broader concerns about how geopolitical and legal issues can impact the cryptocurrency industry. The company’s call for action underscores the challenges faced by global businesses operating in volatile political climates. By seeking support from U.S. authorities and international organizations, Binance aims to secure Gambaryan’s release and address what it views as unjust detention practices.

The outcome of Gambaryan’s case could have significant implications for how similar cases are handled in the future. It may influence diplomatic relations and regulatory approaches within the global cryptocurrency sector. Furthermore, it highlights the need for international cooperation in resolving complex legal disputes that span across borders.

As Binance continues to navigate this challenging situation, the cryptocurrency market remains focused on both the resolution of Gambaryan’s case and the potential for XRP’s price movements. The evolving landscape of digital currencies and regulatory environments will likely continue to shape the industry’s trajectory.

The plight of Binance executive Tigran Gambaryan and the recent surge in Ripple whale activity reflect the dynamic and often turbulent nature of the cryptocurrency market. While Binance seeks global intervention to resolve Gambaryan’s unjust detention in Nigeria, Ripple’s market indicators suggest a potential price rally for XRP. The intersection of legal battles, market movements, and geopolitical issues underscores the complexities facing the cryptocurrency industry today.

Get the latest Crypto & Blockchain News in your inbox.