One of the best ways to tell if a cryptocurrency has a lot of growth potential is if it has robust utility. LUNA, the native token on the Terra blockchain happens to fit that bill particularly well because of how it ties into the Terra ecosystem. The coin is used to facilitate the creation of stablecoins whose value can be pegged to different fiat currencies.

Luna facilitated the creation of the KRT stablecoin whose value is pegged to South Korea’s legal currency, the Won. However, the most notable stablecoin minted through LUNA is the TerraUSD stablecoin also known as UST. Stablecoins have become an essential part of the cryptocurrency market because they not only allow users to move money around easily but also protect themselves from market volatility.

Imagine the kind of growth that a blockchain’s native cryptocurrency can achieve if the network is used to host decentralized applications. It turns out the Terra blockchain hosts CHAI, one of the top Dapps in the world based on user traffic. CHAI has roughly 100,000 users per day and is one of about 12 applications that use KRT to settle payments.

While the aforementioned applications that use KRT and the UST stablecoin generate value for LUNA’s protocol layer, the Mirror protocol has been the biggest demand driver for the native cryptocurrency. But how do these platforms affect demand? The demand aspect is built into the mechanism that Luna uses to maintain the stable price of the stablecoins.

The Terra blockchain uses an incentivized approach that utilizes arbitrage to maintain the right balance in the supply and demand of stablecoins. For example, in case the price of UST goes up, users can mint a specific amount of their LUNA coins to mint UST, thus increasing its supply in the market. A supply increase at a constant demand rate leads to a price drop. In case the price of UST goes up, users can take advantage by buying UST, and burning it to mint LUNA coins. Doing this effectively reduces the supply of UST in the market, leading to a price increase. This mechanism applies to all the stablecoins on the Terra blockchain.

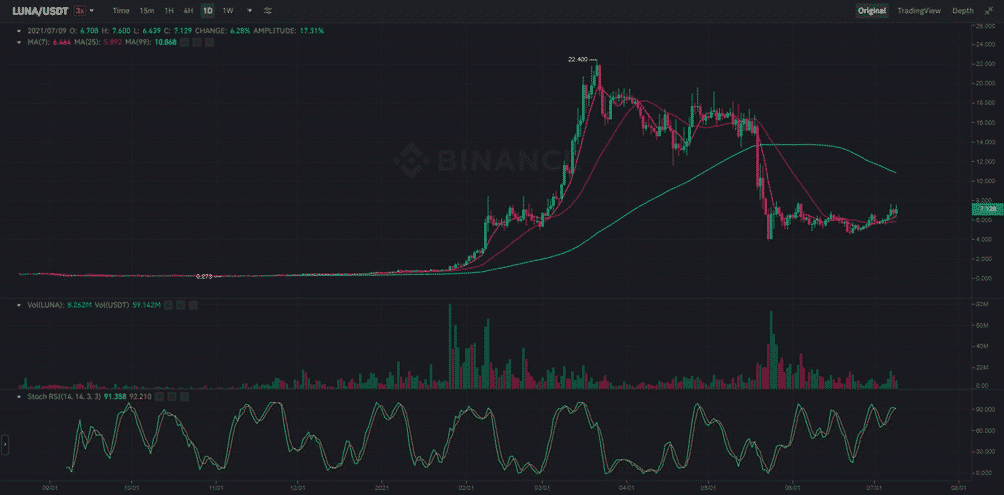

LUNA is also used to mint synthetic assets on the Mirror protocol. These use cases were arguably responsible for the native coin’s parabolic price action earlier this year, during which it soared from as low as $0.67 in January 2021 to a high of $22.33 in March. However, the bearish downturn that kicked off in May sent the price crashing to its current range and it is now trading at $8.12.

Source-Binance

LUNA currently has a $3.4 billion market cap and 419 million coins in circulation. However, it does not have a maximum supply because coins are minted and burned based on stablecoin and mirror asset demand. In other words, its supply can increase or decrease at any given point. However, the high level of utility and increased demand for LUNA as the Terra blockchain demand continues to grow should technically lead to a positive price performance.

The uncertainty in the max supply might suppress its price action but users can still benefit from LUNA by staking it to provide liquidity in the mirror protocol or leveraging the arbitrage opportunities in stablecoin prices. These approaches seem better suited for users who own the LUNA token because they benefit even if the price remains subdued. Price declines actually present an opportunity for users to get in at a lower price point, allowing them to increase their marginal profits when the price gets back on a recovery trajectory. Luna thus is underrated not only from a price point but also in terms of the value it delivers through its utility.

Get the latest Crypto & Blockchain News in your inbox.