Bitcoin’s recent gains earlier this week have been cut short after a UK financial regulator released a report stating that many cryptocurrency companies have not fulfilled anti-money laundering requirements.

The UK’s Financial Conduct Authority revealed on Thursday that as many as 50 companies that deal with cryptocurrencies have not met the UK’s anti-money laundering requirements. Just five companies have so far fulfilled those guidelines ever since the registration process began in 2020. The regulatory watchdog had extended the deadline for registration up to March 22. The report curtailed Bitcoin’s performance just as the market was recovering from the previous downturn.

Bitcoin and most of the top 10 altcoins are in the red following the announcement. The current market performance is a textbook response to negative news which always causes bearish sentiments in the market while positive news tends to fuel bullish sentiments. Bitcoin is currently trading at $36,807 after falling by 5.15% in the last 24 hours.

Bitcoin’s performance has been bullish since Sunday when it rallied from a low of $33,379 to a weekly high of $39,476. Once again the price failed to cross above the $40,000 key price level because of the recent anti-money laundering news from the UK, coupled with the already oversold price, which paved way for more sensitivity to any negative reports.

The recent report from the FCA highlights the increased regulatory concerns as the cryptocurrency market continues to attract more participation globally. Some argue that regulation is important especially now because there has also been an influx of crypto scams in the market.

Concerns about the use of cryptocurrency to launder money have also been growing. Just a month ago, U.S President Joe Biden’s administration introduced a new bill that proposed that all cryptocurrency transactions above $10,000 should be reported to the IRS. The bill aims to introduce strict monitoring as part of the government’s anti-money laundering and tax measures.

Although regulation might be a good thing for the market in overcoming some challenges such as scams, some crypto enthusiasts are concerned that it will violate the decentralized nature of cryptocurrencies. Many traders also see crypto taxation as overreaching by governments. Announcements regarding regulation and taxation have a potent impact on the market because they trigger FUD in the crypto market.

The problem with FUD is that it triggers sell-offs, especially by weak hands. Fortunately, the previous market correction seems to have eliminated most of the weak hands, thus the impact of the latest news does not seem to be as pronounced. So far the price slippage is not as major, indicating that the market is still holding on to bullish sentiments.

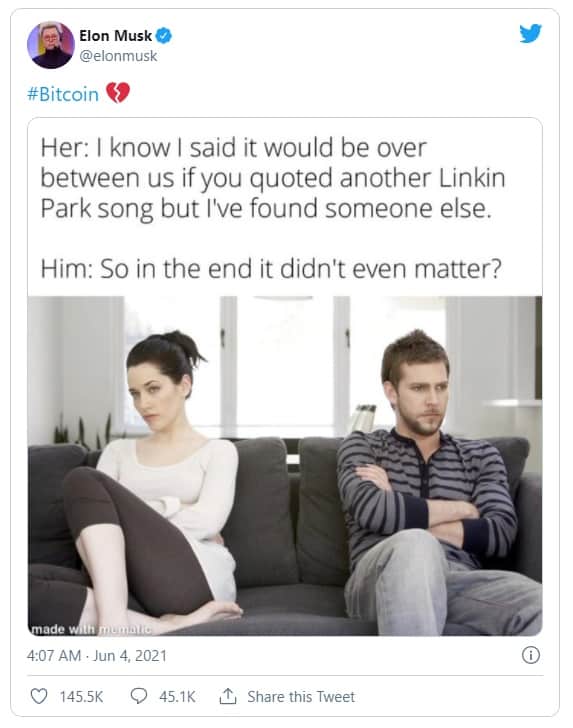

The BTC price slippage may also have been influenced by a recent breakup tweet by Tesla CEO Elon Musk. He also added a Bitcoin hashtag to the breakup meme image and a heartbreak emoji. Many of his followers saw this as a sign that Tesla is offloading its Bitcoin holdings. The EV maker is currently one of the largest institutions that own Bitcoin after its $1.5 billion investment to purchase the cryptocurrency earlier this year.

Elon Musk has received a lot of backlash for tweets that have manipulated Bitcoin price movements in the past and history seems to be repeating itself. The Tesla CEO previously noted in May that his company would hold on to its Bitcoin holdings but did not confirm how long the company plans to hodl its stake. There is currently no official word on whether Tesla has offloaded any of its Bitcoin. Nevertheless, Elon is still receiving heavy backlash on Twitter for spreading FUD and causing some bearishness in Bitcoin’s performance.

Get the latest Crypto & Blockchain News in your inbox.