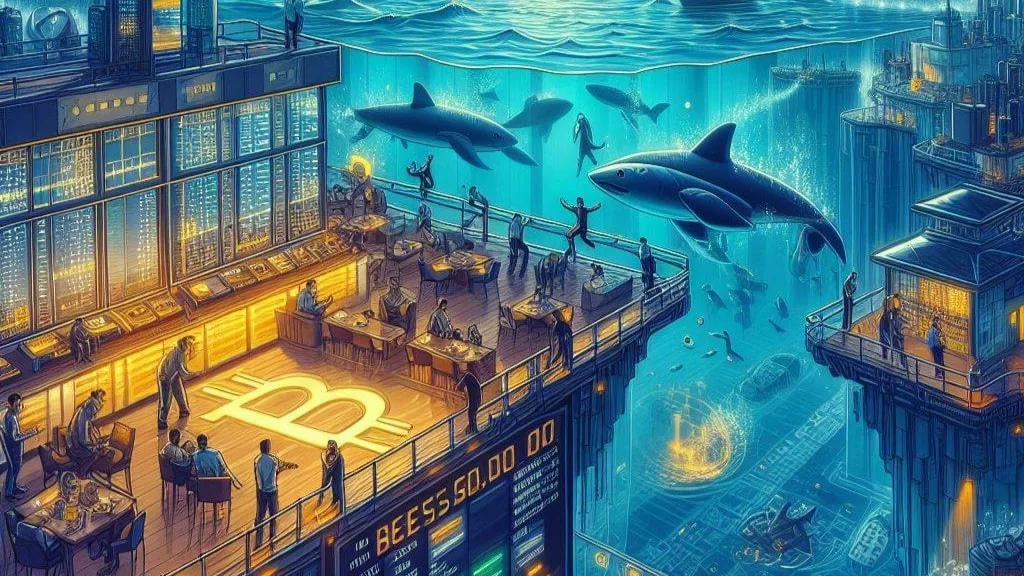

Bitcoin (BTC) has been on a rollercoaster ride, with the recent weekend marked by significant volatility. As Bitcoin faces intense selling pressure, traders are closely monitoring the crucial $60,000 support level. Amidst the uncertainty, optimism prevails fueled by institutional investment rumors and the emergence of a notable futures gap. Join us as we delve into the intricacies of Bitcoin trading, dissecting market trends, and exploring potential pathways for a rebound.

1. Understanding Bitcoin’s Weekend Sell-Off and Resilience

The weekend brought about a sharp decline in Bitcoin’s price, with the cryptocurrency plummeting to $64,522 on Bit stamp, marking its lowest level since March 6. Despite this setback, Bitcoin’s retracement remained relatively modest, indicating resilience in its broader uptrend. While the sell-off was driven by sustained selling pressure in the spot market, exchanges like Coinbase and Binance witnessed continuous spot-selling activities, exacerbating the downward pressure on prices. Analysts have identified key support zones between $60,000 and $64,000, where Bitcoin bids are concentrated.

2. Optimism Amidst Market Correction

Despite the bearish sentiment stemming from the weekend sell-off, optimism prevails among market participants. Expectations of renewed buying interest from United States spot Bitcoin exchange-traded funds (ETFs) have buoyed confidence. Additionally, rumors of institutional investors gearing up to allocate significant funds to Bitcoin have sparked excitement within the community. Thomas Fahrer, CEO of Apollo, emphasized the potential impact of institutional wealth allocation on Bitcoin’s price, suggesting that increased liquidity could drive significant movements. Moreover, attention is drawn to the widening gap in CME Group’s Bitcoin futures market, which presents a potential catalyst for price relief as historical trends indicate these gaps are often filled in subsequent trading sessions.

3. Bitcoin Traders Eye Rebound Amidst Futures-Spot Convergence

As the week unfolds, Bitcoin traders are closely monitoring the convergence of futures and spot prices, anticipating a potential rebound. This convergence could alleviate bearish sentiment and pave the way for renewed upward momentum in Bitcoin’s price action. While the cryptocurrency faces significant selling pressure and has experienced a notable correction, traders remain vigilant, closely monitoring critical support levels and potential catalysts for recovery. The emergence of a substantial futures gap offers hope for relief, but market sentiment remains cautiously optimistic, underpinned by expectations of institutional investment inflows and Bitcoin’s broader resilience.

4. Navigating the Volatile Cryptocurrency Landscape

In conclusion, Bitcoin’s recent price fluctuations underscore the inherent volatility of the cryptocurrency market. While sell-offs and corrections are commonplace, Bitcoin’s resilience and the potential for institutional investments offer hope for recovery. Traders must remain adaptable and vigilant, analyzing market trends and adjusting strategies accordingly. As Bitcoin continues to evolve, navigating the volatile cryptocurrency landscape requires a keen understanding of market dynamics and a forward-thinking approach to investment.

5. The Road Ahead: Charting Bitcoin’s Future Trajectory

Looking ahead, Bitcoin’s trajectory remains uncertain, with various factors influencing its price movements. Continued institutional interest, regulatory developments, and macroeconomic trends will shape Bitcoin’s future path. Traders must stay informed, keeping a close eye on key indicators and developments within the cryptocurrency ecosystem. While challenges lie ahead, Bitcoin’s resilience and the growing acceptance of digital assets point towards a promising future for the world’s leading cryptocurrency.

Get the latest Crypto & Blockchain News in your inbox.