Cardano founder Charles Hoskinson recently made some interesting remarks during an AMA session, including pointing out that pullbacks are inevitable, especially after the market has experienced a 900% rally. The statement perfectly sums up what we have witnessed in the cryptocurrency market on a year-to-date basis.

The market enjoyed a bullish run that pushed many cryptocurrencies to new all-time highs. For example, Bitcoin reached an ATH of $64,854 on Binance, but its price has since lost nearly half its gains. Many other cryptocurrencies that enjoyed a strong surge have also experienced strong pullbacks. Hoskinson noted in the AMA session that the crypto market goes through boom and bust cycles primarily influenced by the magnitude of innovations in the segment.

The Cardano founder noted that there is over-justification and over-enthusiasm in the market, which contributes to enormous gains, and over-pessimism, responsible for the pullbacks. Everyone is now wondering whether the market will recover or whether the recent bear market will continue to cause more market erosion.

Here’s why the bulls might take back control

Institutional investors have a notable impact on the market and are arguably one of the major reasons for the crypto bull run in 2021. Suppose more institutional investors buy cryptocurrencies such as Bitcoin. In that case, the overall market sentiment is bound to be positive, and this creates a feedback loop that leads to a frenzy of buying by retail traders and hodlers. Unfortunately, the reverse also applies where prices fall drastically when institutional participants their crypto holdings.

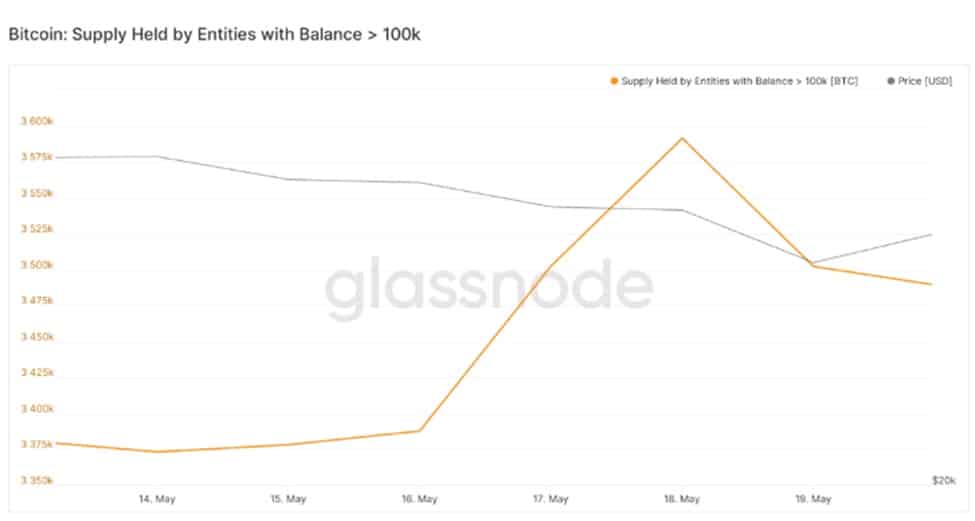

There was significant selling on May 18, likely due to the recent reports that China was tightening its anti-crypto restrictions. This may have triggered more selling, thus the overall bearish sentiments in the market in the last week. The above chart shows that the supply of Bitcoin held by institutional buyers has been declining but is still at healthy levels. Elon Musk recently hinted that he does not plan to sell Tesla’s Bitcoin holding.

The lower price levels also present a good entry point for whales, leading to some price recoveries. However, more buying by institutional investors would provide the catalyst that the market needs for a substantial recovery. Bitcoin still occupies the largest share of the entire cryptocurrency market cap. Its performance reflects the market sentiments and influences the performance of most of the other cryptocurrencies in the market.

In the last week, the bearish outlook in the cryptocurrency market was fueled mainly by FUD, thus continued sell-offs, presumably from newer market participants. There has been some buying supported by spot market participants in anticipation of price recovery, especially for Bitcoin, which tested support near the $30,000 price level once again on Sunday.

Bitcoin’s price bounced back above $38,000 within the last 24 hours, supported by some buying volume, and the price is just bouncing back from the oversold levels on the Stochastic RSI. The bounce-back reflects the lower-price entries, but the market has not recovered from the bearish shock experienced in the previous week.

The market might continue to experience some more price recovery if supported by more buying volume, especially by strong hands, and favorable news, contrary to what happened a week before. There is still the risk of a continued bear market, especially with the absence of strong developments that can help the market shed some of the FUD in favor of more market confidence. For example, When Bitcoin surpassed the $50,000 price level for the first time, there was a lot of confidence that it would peak above $250,000 especially if it matched gold’s market cap. However, the speculative nature of the cryptocurrency market means there will always be market corrections which are inevitable especially when prices are high and sensitive to any negative developments.

Get the latest Crypto & Blockchain News in your inbox.