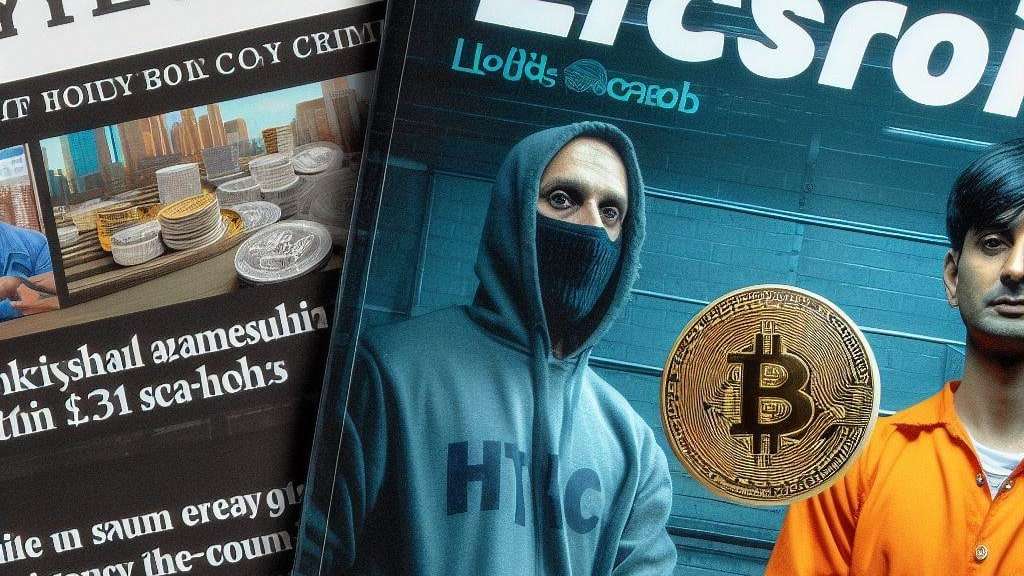

In a jaw-dropping turn of events, Srikrishna Ramesh, widely known as Sriki, has once again made headlines for orchestrating a daring $1.2 million Bitcoin heist from the confines of a prison cell in Parappana Agrahara, India. Sriki, arrested in 2020 for hacking Bitcoin and other cryptocurrencies worth millions, allegedly bribed a guard to smuggle a laptop into his quarantine cell, where he executed the swift transaction in just 22 minutes.

The intricacies of this audacious operation, which took place inside a quarantine cell, remain shrouded in mystery. The shocking revelation has prompted authorities to launch a thorough investigation into how Sriki managed to conduct such a high-value crypto transaction while behind bars.

Sriki, initially apprehended by the Central Crime Branch for purchasing drugs through the DarkNet, was later found to be a key player in various crypto scams. Despite being confined in a quarantine prison in Bengaluru, he reportedly moved $1.2 million in Bitcoin after allegedly bribing a police officer to bring him a laptop with internet access.

Sources suggest that the constable, complying with Sriki’s request, facilitated the transfer of Bitcoin at the behest of some influential individuals. The entire operation unfolded in approximately 20-22 minutes, during which Sriki had access to the laptop inside the cell.

The Hindu reports that Sriki subsequently laundered the money within the prison, utilizing a covert and undisclosed network. Authorities, particularly the Special Investigation Team (SIT), are now scrutinizing the incident and reviewing wallets to gather more information on the money laundering process.

Meanwhile, the crypto landscape faces another threat as Lloyds Banking Group issues a crypto scam report revealing the alarming rise of scams on social media platforms. The report highlights Sriki’s case as a stark example of the evolving tactics employed by hackers in the digital age.

The report indicates that crypto scams, particularly targeting the age group of 25 to 34, have surged by 23% in 2023. Victims’ losses have risen to £10,741 ($13,300) from £7,010 ($8,750) in 2022. Lloyds warns that scammers often recruit victims through social media sites like Meta’s Facebook and Instagram, with the majority of transactions utilizing the quick payments service Revolut.

However, the report emphasizes that Revolut is not the final destination for stolen assets, as victims unknowingly make multiple payments to scammers over 100 days before realizing they have been duped. Crypto investment scams have now surpassed more common cons, such as romance and purchase frauds, making them the most prevalent in the current landscape.

As the crypto community grapples with the aftermath of Sriki’s audacious prison heist and the rising tide of scams, vigilance and awareness become paramount in navigating the complex and ever-evolving world of digital assets. Stay informed to protect yourself from the lurking dangers in the crypto underworld.

Get the latest Crypto & Blockchain News in your inbox.