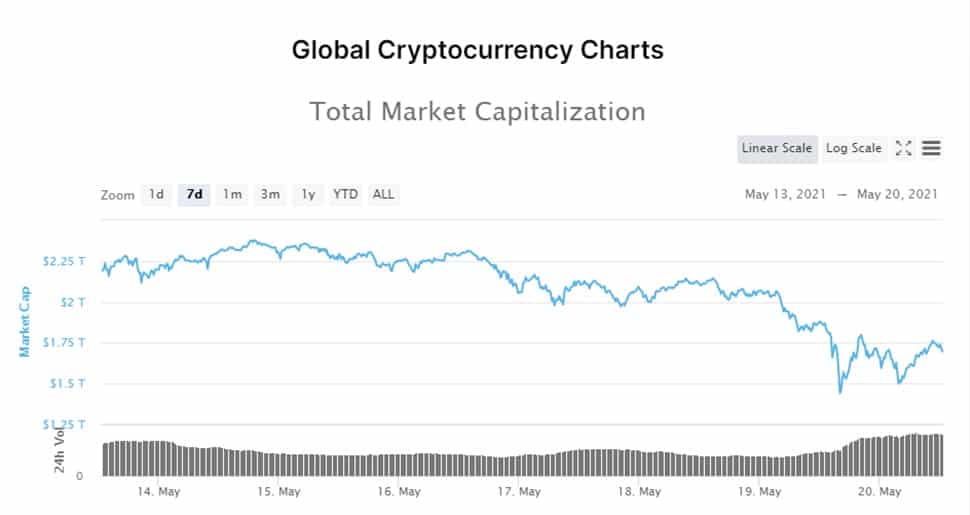

The cryptocurrency market has been experiencing a hell of a roller-coaster ride in May as price volatility increases to a new high driven by multiple factors, including FOMO, market news and Elon Musk. Its performance in the last 24 hours highlights a scary dip that wiped out a considerable amount of previous gains from the market.

The market capitalization for the entire cryptocurrency market dropped from a high of $2.06 trillion to $1.4 trillion within the last 24 hours. The culprit behind the latest crypto crash is a warning statement highlighting the Chinese government’s decision to ban institutions, including banking and remittance companies, from conducting any cryptocurrency-related business.

The Chinese crypto ban was a massive blow to the crypto market because Chinese traders made a significant contribution to the market, especially for Bitcoin. China’s recent crypto crackdown means Chinese traders will most likely cease to have any influence over the crypto market.

The latest crypto ban may have spooked institutional buyers

Wednesday’s crypto plunge might have been curtailed by the fact that there are institutional players in the market this time, compared to the 2018 crash. However, such a considerable crash seems to have spooked some institutional investors who are now exiting their Bitcoin positions favouring gold, whose price is relatively more stable.

On the other hand, the recent crypto crash may have opened up an opportunity for more institutional and individual investors to buy the dip, thus benefiting from a more favourable price point. It explains the market correction, especially in the price of Bitcoin from its 24-hour low of $30,000. Fortunately, it looks like Tesla, Inc. (NASDAQ: TSLA) does not plan to offload its Bitcoin holding anytime soon, judging by its CEO Elon Musk’s diamond hands tweet, implying that he is hodling. Tesla is one of the largest institutional buyers in the crypto market, and its decision to hold or sell will have a substantial impact on the market.

Interestingly, Elon Musk fueled a major sell-off just days ago with a previous tweet about Bitcoin mining being energy-intensive and Tesla no longer accepting Bitcoin as payment for EV purchases. The move triggered a lot of backlash, and the latest crash will likely encourage him to be more careful with his tweets, now that his crypto holdings also face the risk of erosion.

The Bitcoin bear market was more severe on altcoins than on Bitcoin

Although Bitcoin investors felt the pinch during Wednesday’s Bitcoin downturn, altcoin holders suffered the most. Bitcoin only tanked by about 30% during the massive sell-off but numerous altcoins lost by higher margins. Shiba Inu, one of the most hyped coins, tumbled by more than 48% during Wednesday’s trading session, and the price dropped lower than 0.00001 at some point before recovering back above that level. PancakeSwap is down more than 37% in the last 24 hours, while Terra’s Luna coin lost 34.06% during the same session.

Will the crypto market recover?

Many cryptocurrencies are currently in the correction phase, including Bitcoin, whose price has rallied back above $40,000, indicating that the market has exhausted the impact of the Chinese crypto news. Fear, uncertainty and doubt seem to be taking a step back in favour of bullish optimism. However, the market is still sensitive to news, whether positive or negative.

It would be wise to watch out for the type of news that comes out in the next few days because it will determine whether prices will hold strong or continue on a downward spiral. The latest information suggests that Tesla is not selling its Bitcoin yet, and prices are still at favorably low levels.

Get the latest Crypto & Blockchain News in your inbox.