US spot Bitcoin ETFs through innovative channels like the Liberalized Remittance Scheme (LRS). Delve into the complexities of this trend and its impact on India’s evolving cryptocurrency ecosystem.

Introduction: Navigating Regulatory Complexities in Cryptocurrency Investments

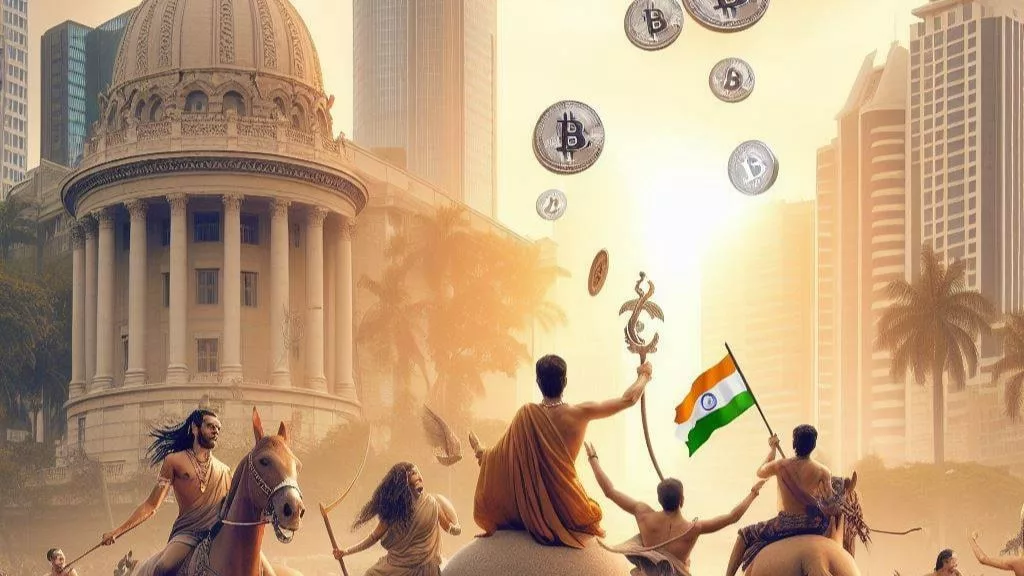

In the ever-evolving realm of cryptocurrency investments, regulatory uncertainties and taxation policies pose formidable challenges for investors worldwide. Against this backdrop, affluent Indian investors are charting a new course by leveraging the Reserve Bank of India’s Liberalized Remittance Scheme (LRS) to gain exposure to US spot Bitcoin ETFs. This groundbreaking approach reflects the shifting dynamics of global cryptocurrency markets and underscores the need for a nuanced understanding of regulatory frameworks.

Unveiling the Utilization of Remittance Quota for Crypto Investments

The Reserve Bank of India’s Liberalized Remittance Scheme (LRS), introduced in January, offers Indian citizens the opportunity to remit up to $250,000 annually for investments in overseas securities, including Bitcoin ETFs. This regulatory provision has catalyzed a surge in demand for US spot Bitcoin ETFs among Indian investors, as they seek alternative avenues to navigate India’s stringent cryptocurrency regulations. Platforms like Vested Finance have emerged as key facilitators, enabling Indian investors to access offshore cryptocurrency markets and capitalize on global investment opportunities.

Evaluating India’s Taxation Policies and Their Impact on Crypto Investments

India’s cryptocurrency taxation regime, characterized by a flat 30% tax on crypto profits and a 1% TDS on crypto trading, has incentivized investors to explore offshore platforms for cryptocurrency investments. By utilizing the LRS, Indian investors can potentially mitigate their tax liabilities and optimize their investment returns. This strategic maneuvering underscores the resilience and adaptability of Indian investors in the face of regulatory challenges, as they seek to capitalize on the transformative potential of cryptocurrencies while navigating regulatory complexities.

Partnering for Access: The Role of Collaborations in Facilitating Crypto Investments

Collaborations between leading platforms like Mudrex and Vested Finance have played a pivotal role in facilitating access to US spot Bitcoin ETFs for Indian investors. Through strategic partnerships, these platforms offer streamlined solutions that enable investors to navigate regulatory hurdles and access offshore cryptocurrency markets with ease. The partnership between Mudrex and Vested Finance exemplifies the synergy between innovation and regulatory compliance, empowering Indian investors to participate in global cryptocurrency markets while adhering to local regulations.

Central Bank Caution and the Path Forward

Amidst growing interest in cryptocurrency investments, the Reserve Bank of India has maintained a cautious stance on digital assets, citing regulatory concerns and potential risks. Governor Shaktikanta Das’s reaffirmation of the bank’s unchanged position on cryptocurrencies underscores the need for a balanced approach to regulation, one that fosters innovation while safeguarding investor interests. As Indian investors continue to explore offshore cryptocurrency markets, policymakers must engage in constructive dialogue with industry stakeholders to develop a regulatory framework that promotes market integrity and investor protection.

Conclusion: Embracing Innovation in a Dynamic Crypto Landscape

The convergence of regulatory complexities and investor aspirations in the cryptocurrency landscape presents both challenges and opportunities for Indian investors. By leveraging innovative channels like the Liberalized Remittance Scheme (LRS), Indian investors are unlocking new avenues for accessing global cryptocurrency markets and diversifying their investment portfolios. As the cryptocurrency ecosystem continues to evolve, collaboration between industry stakeholders and policymakers will be essential in fostering a regulatory environment that fosters innovation, promotes market integrity, and safeguards investor interests. In this dynamic landscape, Indian investors stand poised to navigate regulatory complexities and capitalize on the transformative potential of cryptocurrencies, reshaping the future of finance on a global scale.

Get the latest Crypto & Blockchain News in your inbox.