You may have noticed that Bitcoin has maintained a strong grip over the cryptocurrency market ever since digital currencies became a thing. Whenever there is some positive Bitcoin news, its price rises and so does the rest of the crypto market. However, BTC’s impact seems to be a double-edged sword because prices also fall when there is some negative news about Bitcoin.

Take, for example, the news about China’s crackdown on Bitcoin mining which is one of the major reasons for Bitcoin’s latest price drop, alongside concerns about Bitcoin mining’s impact on the environment. Interestingly, even altcoins that use proof-of-stake consensus mechanisms also experienced sharp price drops.

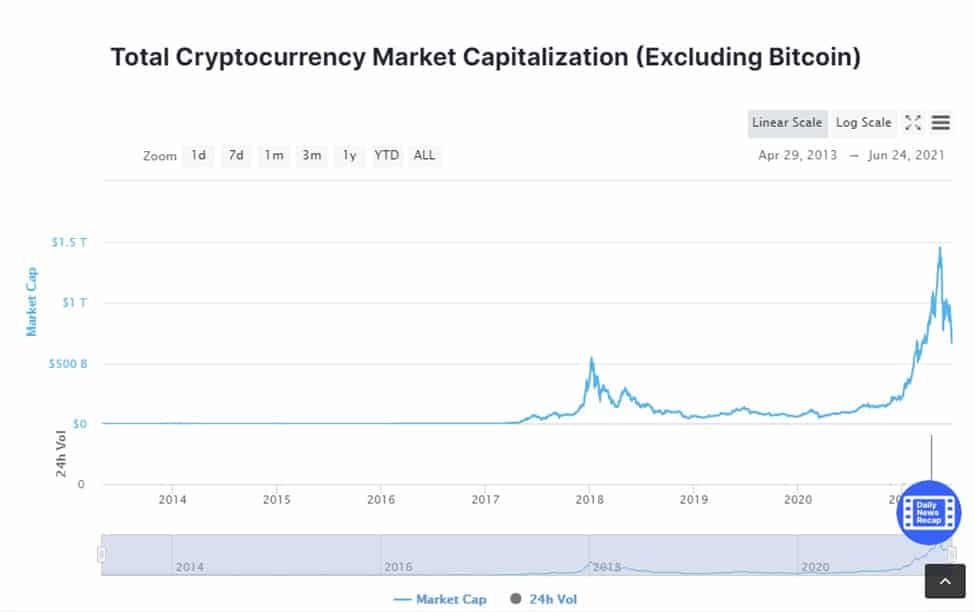

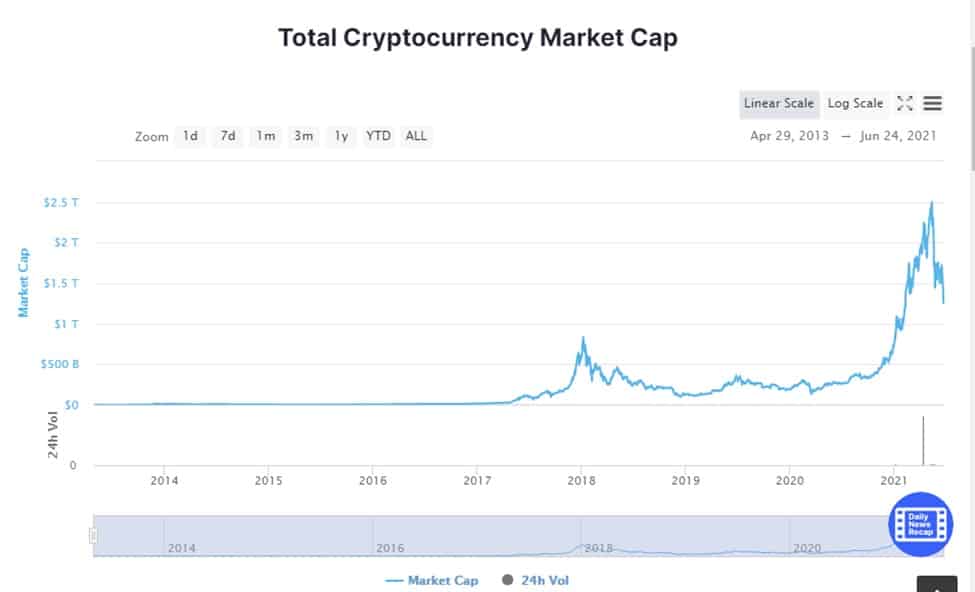

Bitcoin’s control over the altcoin market comes from the fact that it had the first-mover advantage. Not only was it the first cryptocurrency, but it also happens to be the most valuable. Its current market cap is $631 billion which is currently 46.4% of the total cryptocurrency market cap which is currently at $1.35 trillion. Because of this huge influence, altcoin investors use it as a yardstick for determining market direction such that altcoin buying and selling relies largely on BTC price action. The following charts highlight the impact of Bitcoin’s price movements.

There are multiple reasons why the world needs to rise above Bitcoin’s market dominance. Bitcoin paved the way just like how Netscape Navigator cleared a path for modern-day browsers. Similarly, Bitcoin will eventually lose its dominance or influence over altcoin price movements.

One of the reasons is because Bitcoin has many challenges such as the energy-intensive mining approach that is used to achieve consensus on the network. It is an expensive process that is also responsible for the expensive transactions on Bitcoin’s network. Meanwhile, multiple other blockchains have notably lower fees. The limited utility is also a major problem for Bitcoin while many other cryptocurrencies have compelling use cases that generate actual value.

BTC is only valuable because everyone agrees that it is a store of value. It was initially supposed to be used for transactions but it seems to have failed at that due to the hefty fees and inflated value. If you think about it, the altcoin market would perform just fine if Bitcoin was no longer a thing. For example, Ethereum is rapidly becoming the protocol layer for the internet of value and that supports ETH’s value. Utility tokens would still have a place in the world and possibly thrive without being overshadowed by Bitcoin.

When Tesla CEO threw shade over Bitcoin in May for its allegedly contributing to global warming due to the use of electricity generated from fossil fuels, crypto prices started tanking. However, some proof-of-stake cryptocurrencies such as Cardano experienced an uptick, proving that they could free themselves of Bitcoin’s influence as far as price performance is concerned.

Bitcoin’s market dominance has also been on the decline, which means that altcoins are finally receiving more attention. This is critical because it means people are finally embracing altcoins for the value that they can provide based on their utility and underlying projects. Bitcoin’s current 46.4% market dominance is a far cry from the 90% plus market dominance in its early days. The market will eventually reach a point where people will opt not to sell their crypto holdings and instead hodl or put them to good use by staking so they can earn interest.

Hodling altcoins seems like a good way to get rid of Bitcoin’s spell over the rest of the market especially when it is experiencing a decline. The rise of cryptos backed by robust development and strong use cases may further provide incentives for people to avoid selling their altcoins so that they can continue leveraging growth opportunities. Such a trend will continue to prevail especially if people start buying such altcoins based on market research rather than blind speculation.

Get the latest Crypto & Blockchain News in your inbox.