In a significant move towards strengthening its presence in the digital asset industry, Boerse Stuttgart Digital, a subsidiary of the renowned Stuttgart Stock Exchange, is preparing to unveil a groundbreaking cryptocurrency staking service next year. This strategic initiative reflects the growing commitment of traditional financial institutions to engage with the maturing digital asset ecosystem, providing enhanced security and confidence for investors.

At the heart of this groundbreaking development lies a partnership with Munich Re, a global reinsurance giant, which has meticulously crafted an insurance offering to mitigate the inherent risks associated with slashing in the world of cryptocurrencies. For those unfamiliar with the term, slashing refers to the punitive measures taken against validators in proof-of-stake blockchain networks. When these validators make errors, whether through intentional malicious activities or inadvertent infractions against the network’s governance rules, they may risk forfeiting or locking their staked tokens. By introducing an insurance layer into this system, stakeholders can operate with an additional layer of confidence, effectively minimizing potential losses.

This move by Boerse Stuttgart Digital is not isolated but rather part of a broader trend where prestigious financial institutions are progressively expanding their capabilities in the cryptocurrency space. Just this week, Deutsche Bank, Germany’s flagship lender, announced its collaboration with Taurus, focusing on digital asset custody and tokenization. Similarly, global banking titan HSBC is forging connections with Fireblocks, a heavyweight in the crypto custody industry. Across the Atlantic in the United States, Franklin Templeton, a renowned asset management firm, is gearing up to launch the first spot Bitcoin ETF.

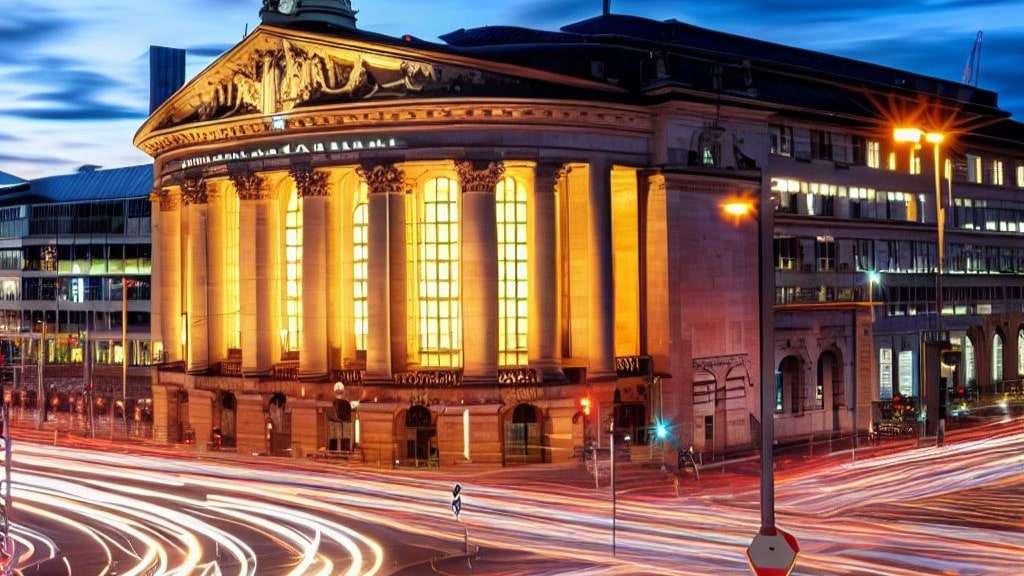

Boerse Stuttgart Digital, a subsidiary of the Boerse Stuttgart Group, Europe’s sixth-largest stock exchange consortium, has further solidified its position in the crypto domain by securing a license earlier this year. This certification, issued by Germany’s financial overseer, BaFin, allows the company’s subsidiary, Blocknox GmbH, to securely custody digital assets.

By incorporating staking into its range of custody services, Boerse Stuttgart Digital is paving the way for its clientele to earn rewards on assets held with the institution. Dr. Oliver Vins, the esteemed managing director of Boerse Stuttgart Digital, has emphasized the firm’s keen observations regarding the surge in institutional interest within the staking arena. However, the key requirement for these institutions is a secure and reliable environment, a need that Boerse Stuttgart Digital aims to fulfill with this strategic move.

Get the latest Crypto & Blockchain News in your inbox.