The victim, a senior citizen in his 60s, fell victim to the allure of astronomical returns promised by the fraudulent pair. With promises of a 70% return on investment within a mere month, the scammers enticed the elderly investor into parting with his hard-earned funds, dangling the prospect of substantial profits in exchange for his trust.

“If you invest 1 billion won, it will be 1.7 billion won a month later,” the victim was assured.

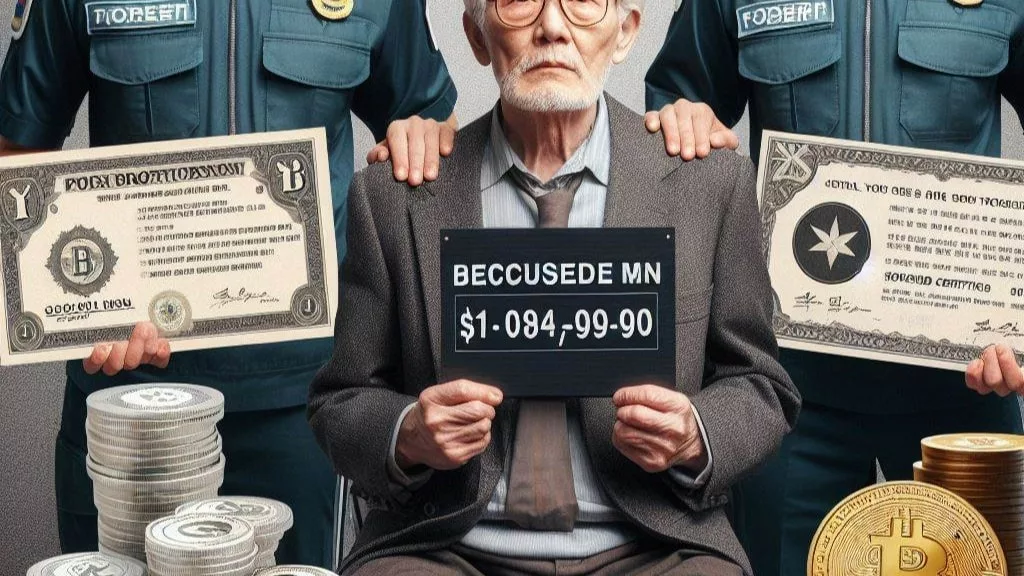

Trusting in these assurances, the victim transferred the funds to the alleged fraudsters, only to be met with deceit and betrayal. The duo went as far as fabricating counterfeit certificates, falsely validating the victim’s investment and inflating the value of non-existent cryptocurrency holdings. Astonishingly, the forged documents purported a value of $20 million in crypto assets, a blatant distortion of reality aimed at perpetuating their illicit scheme.

South Korean authorities, however, were quick to intervene, apprehending the perpetrators and thwarting their deceptive endeavors. The arrests serve as a stern warning against the dangers of fraudulent investment schemes and underscore the importance of vigilance in safeguarding one’s financial assets, particularly in the rapidly evolving landscape of digital currencies.

The modus operandi of the fraudsters was as audacious as it was deceitful. Pledging an astronomical 70% return on investment in just one month, they painted a picture of immense wealth awaiting those who dared to invest with them. “If you invest 1 billion won, it will be 1.7 billion won a month later,” one of the fraudulent promises echoed.

However, the reality was far grimmer than the tantalizing prospects laid out by the scam artists. After the victim handed over the funds, the duo resorted to fabricating fake certificates to feign legitimacy. These falsified documents purportedly showcased a staggering $20 million worth of cryptocurrency investments, despite the fact that no such transactions had taken place.

In a dramatic twist, South Korean authorities intervened, apprehending the perpetrators and putting an end to their fraudulent activities. The crackdown serves as a stark reminder of the perils lurking within the realm of cryptocurrency investment, where promises of quick riches often conceal elaborate scams designed to prey on the unsuspecting.

Meanwhile, in a separate development within the realm of cryptocurrency, the Supreme Court of Montenegro has made a significant decision regarding the extradition of Do Kwon, the embattled founder of Terra (LUNA). Following a tumultuous legal battle, the court overturned a previous ruling that sanctioned Kwon’s extradition to South Korea, where he faces allegations related to the 2022 collapse of the Terra ecosystem.

The decision marks a pivotal moment in Kwon’s legal saga, casting uncertainty over his impending return to his homeland to face charges of purported crimes. As legal proceedings continue to unfold, observers await further developments in the case, pondering the implications for both Kwon and the broader cryptocurrency community.

In conclusion, the unraveling of the $4.1 million crypto scam in South Korea serves as a stark reminder of the perils lurking in the digital financial domain, while the legal maneuverings surrounding Do Kwon’s extradition underscore the complexities and uncertainties inherent in the cryptocurrency landscape. As stakeholders navigate these turbulent waters, vigilance and prudence remain paramount in safeguarding against financial exploitation and upholding the integrity of the burgeoning crypto sphere.

Get the latest Crypto & Blockchain News in your inbox.