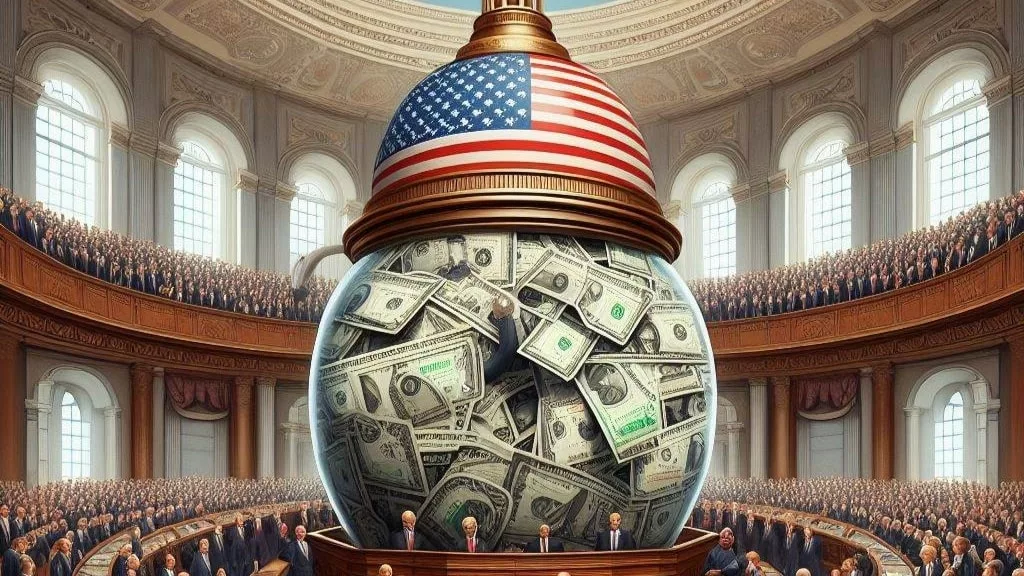

In a move that could reshape the dynamics of global finance, the US House of Representatives has greenlit the Rebuilding Economic Prosperity and Opportunity (REPO) Act. This legislative stride, if fully enacted, could pave the way for the confiscation of over $6 billion worth of Russian assets tucked away in US financial institutions. But what does this mean for the broader international economic landscape?

Experts are buzzing with anticipation over the potential ramifications of such a bold maneuver. At the heart of the matter lies the notion that such actions could significantly accelerate the ongoing trend of de-dollarization, wherein countries seek to reduce their reliance on the US dollar in international transactions.

Paul Goncharoff, a seasoned expert in economic consultancy, emphasizes that the REPO Act, if enforced, could inadvertently bolster the case for de-dollarization among various nations. Goncharoff suggests that the act could be perceived as a form of coercion, compelling nations to reconsider the risks associated with holding assets subject to potential seizure at the whim of US policy shifts.

“It just supercharges de-dollarization,” Goncharoff asserts, highlighting the growing discomfort among nations reliant on the dollar as the world’s primary reserve currency. He underscores the fragility of the current system, where the US sustains its economy through mounting debt fueled by foreign investments in treasury bonds.

But concerns about the REPO Act aren’t confined to foreign analysts alone. Even domestically, voices of dissent are making themselves heard. The Heritage Foundation, a conservative-leaning think tank, has raised alarms about the broader implications of granting such sweeping powers to the Biden administration.

In a recent publication, the Foundation warns that while the intentions behind the bill may be noble, its execution could have far-reaching consequences. They caution that empowering the government to confiscate assets may destabilize the dollar-dominated global financial framework, potentially triggering unintended economic fallout.

The passage of the REPO Act underscores a broader geopolitical tension between the US and Russia, echoing sentiments reminiscent of the Cold War era. Against a backdrop of strained relations, economic measures such as asset seizures serve as yet another chapter in the ongoing saga of geopolitical brinkmanship.

As nations around the world closely monitor these developments, the specter of de-dollarization looms large on the horizon. Countries previously content to rely on the stability of the dollar are now reevaluating their strategies in light of shifting geopolitical dynamics and the ever-present specter of economic coercion.

For some, the prospect of a multipolar financial landscape offers a tantalizing vision of increased autonomy and resilience against external pressures. Yet, for others, the uncertainties inherent in such a transition pose significant challenges, raising questions about the stability of the global economic order.

In the face of these uncertainties, policymakers are grappling with the delicate balance between economic pragmatism and geopolitical assertiveness. The REPO Act serves as a stark reminder of the interconnectedness of global finance and politics, where every policy decision reverberates across borders with far-reaching implications.

As the REPO Act makes its way through the legislative labyrinth, one thing remains abundantly clear: the world is bracing for a seismic shift in the geopolitical and economic landscape. Whether this shift heralds a new era of multipolar cooperation or exacerbates existing tensions remains to be seen. But one thing is certain: the wheels of change are already in motion, and the global economy hangs in the balance.

Get the latest Crypto & Blockchain News in your inbox.