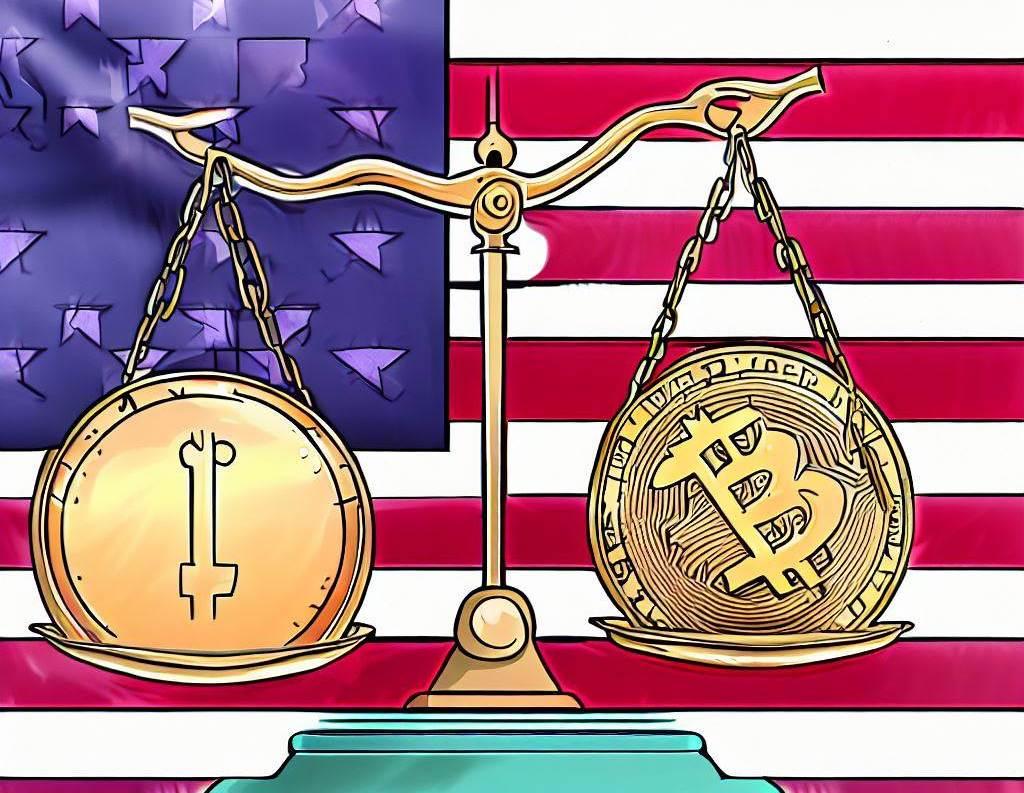

In recent months, the cryptocurrency industry has witnessed a series of legal disputes involving prominent players such as Coinbase and Custodia, the Bitcoin bank. These battles highlight the ongoing struggle between crypto companies and regulatory authorities, with both sides striving to find a balance between innovation and consumer protection.

Coinbase, a leading cryptocurrency exchange, has been at odds with the U.S. Securities and Exchange Commission (SEC) over its Lend product. This offering allows users to earn interest on their digital assets. However, the SEC claims that the product is a security and requires registration under federal securities laws. Despite the agency’s warning, Coinbase refuses to back down and is prepared to defend its position in court if necessary. The company asserts that the Lend product is not a security and should not be subject to securities regulations.

This unwavering stance by Coinbase sends a strong message to the crypto community and regulators alike. The exchange is committed to innovation and providing services that benefit its users, even in the face of regulatory scrutiny. As a result, Coinbase has gained significant support from industry leaders and advocates who believe that the SEC’s actions could stifle innovation in the rapidly evolving crypto space.

Meanwhile, Bitcoin bank Custodia is also embroiled in a legal dispute with the Federal Reserve. The bank filed a lawsuit against the regulatory body, demanding a decision on its application for a master account. This account is essential for Custodia to access the U.S. payment system and provide banking services to its customers.

Custodia’s struggle highlights the challenges faced by cryptocurrency-focused banks in obtaining essential banking licenses and approvals. While the Federal Reserve has granted master accounts to other innovative financial institutions, the regulatory body appears hesitant to extend the same privileges to a bank focused on Bitcoin and other digital assets.

Both of these legal battles underscore the ongoing tension between the crypto industry and regulatory authorities. As the sector continues to grow and evolve, it is essential for regulators to find a balance between fostering innovation and protecting consumers. In the case of Coinbase and Custodia, their determination to stand their ground sends a clear message that the crypto industry will not be easily deterred by regulatory hurdles.

As the outcomes of these disputes unfold, they will likely have a significant impact on the future of cryptocurrency regulation and the development of innovative financial products and services. Ultimately, the ability of the industry to navigate these challenges will be crucial in shaping the future of the global financial landscape.

In conclusion, the legal battles involving Coinbase and Custodia demonstrate the cryptocurrency industry’s resilience and commitment to innovation. These disputes serve as a reminder that the crypto sector is prepared to defend its interests and fight for a fair and balanced regulatory environment that supports growth and benefits consumers. With the outcomes of these cases set to influence the future of crypto regulation, the stakes have never been higher for the industry and its supporters.

Get the latest Crypto & Blockchain News in your inbox.