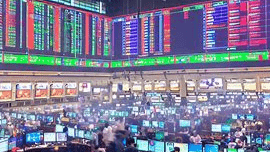

In the ever-changing world of global finance, Asian stock markets have been experiencing mixed sentiments, navigating a complex landscape driven by Chinese stimulus measures and challenges in the technology sector. As investors weigh the implications of economic recovery efforts and assess the impact of tech stock weakness, the region’s key indexes face fluctuations and volatility.

The Chinese government has taken proactive steps to support economic growth, announcing new measures aimed at boosting spending in the automobile and consumer electronics sectors. The National Development and Reform Commission’s move comes as data reveals a slowdown in China’s economic recovery during the second quarter. In response, authorities have promised more policy support to revitalize the economy.

Despite these promising stimulus efforts, investors remain cautiously optimistic. Fund managers have grown less confident about China’s economic recovery this year, as weak economic indicators and limited policy support contribute to their hesitancy. Some economists have even issued warnings that local stocks could test 11-year lows, signaling concern over the potential loss of momentum in the post-COVID economic rebound.

The impact of China’s economic performance is not confined to its borders. Many Asian markets are heavily dependent on the country as a key trading hub. Consequently, any fluctuations in China’s economy can have a ripple effect, affecting broader Asian markets.

While some markets struggled, Hong Kong’s Hang Seng index emerged as the best performer in Asia, benefiting from the strength of locally-listed Chinese stocks. However, the Shanghai Shenzhen CSI 300 and Shanghai Composite indexes experienced resistance after relinquishing most early gains. Despite their setbacks, all three indexes managed to trim some weekly losses on Friday.

The tech-heavy Asian bourses faced challenges due to weakness in heavyweight technology shares. A slide in major U.S. technology stocks and disappointing earnings results from prominent companies like Netflix and Tesla weighed on investor sentiment in the Asian tech sector. For instance, Taiwan Semiconductor Manufacturing Co (TSMC), considered Asia’s most valuable company, witnessed a 3% decline after reporting a 23% drop in second-quarter profits. The chipmaking giant also warned of further sales and profit declines throughout the year. Similarly, Hong Kong’s Sunny Optical Technology Group, a major smartphone component manufacturer, signaled a substantial profit decline in the first half of 2023.

The tech sector’s weakness had implications for broader Asian stocks, leading to declines in the South Korean KOSPI and Taiwan’s Weighted index. Additionally, Australia’s ASX 200 experienced a setback amid concerns over slowing commodity demand in China. Meanwhile, Japanese markets displayed mixed sentiments, with the Nikkei 225 declining slightly, while the broader TOPIX remained stable. The Bank of Japan’s potential policy tightening in response to steady consumer inflation added to the market’s cautious stance.

Amidst these challenges, Indian stocks bucked the trend, showcasing remarkable performance. The Nifty 50 and BSE Sensex 30 indexes reached record highs for the fourth consecutive session, reflecting India’s resilience and potential as an emerging market.

As the world closely observes the dynamics of Asian stock markets, investors and analysts alike continue to analyze the impact of Chinese stimulus measures and navigate through tech stock weakness. They remain vigilant in their decision-making process, fully aware of the market’s inherent volatility and potential opportunities.

In conclusion, Asian stock markets continue to face a mix of opportunities and challenges, influenced by various global and regional factors. The interplay between Chinese stimulus measures, economic recovery efforts, and tech stock weakness keeps investors on their toes, with each market exhibiting unique dynamics and potential implications for the wider global economy. As investors monitor developments in the region, they adapt their strategies and make informed decisions to ride the waves of uncertainty and seek opportunities for growth and stability.

Get the latest Crypto & Blockchain News in your inbox.