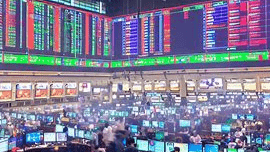

Most Asian stocks experienced gains on Wednesday as investors speculated that the Federal Reserve’s current rate hike cycle may be approaching its end. Positive cues from a strong session on Wall Street, driven by better-than-expected bank earnings and easing inflationary pressures, boosted investor confidence in risk-driven assets. However, Chinese markets continued to underperform amid concerns over the country’s economic outlook.

The Nikkei 225 index in Japan was the best performer among its Asian peers, rising by 1% to close at [value]. The broader TOPIX index also gained 1% to [value]. The strong performance of Japanese stocks was largely driven by the automotive sector, with major companies such as Nissan Motor and Mazda Motor leading the gains. Nissan Motor saw its shares rise by 6%, while Mazda Motor witnessed a 4% increase. Investors showed optimism ahead of the companies’ upcoming earnings announcements.

In Australia, the ASX 200 index added 0.5% to close at [value], reflecting positive sentiment in the market. The rise was supported by gains in the Energy, Financials, and A-REITs (Australian Real Estate Investment Trusts) sectors. The overall upbeat mood in the market was influenced by the strong overnight session on Wall Street, where better-than-expected bank earnings and a smaller-than-expected rise in retail sales pointed to easing inflationary pressures.

Philippine shares led gains across Southeast Asia, with the market rising by 0.3%. The positive performance was attributed to strong domestic economic data, including robust GDP growth and improving consumer confidence. Additionally, investor sentiment was bolstered by positive developments in the country’s vaccination efforts and ongoing government infrastructure projects.

Indian stocks reached record highs, with both the Nifty 50 and the BSE Sensex 30 indices hitting new milestones. The surge in Indian stocks was driven by strength in major technology stocks and optimism surrounding Reliance Industries’ demerger of its financial unit. The financial sector also contributed to the upward momentum, with strong earnings from major Indian banks boosting investor confidence. However, some analysts suggest that a period of consolidation may be on the horizon as local indexes have reached new highs for the past two weeks.

On the other hand, Chinese markets, including the Shanghai Shenzhen CSI 300 and Shanghai Composite indexes, continued to lag behind their regional peers for the third consecutive session. Investors remained cautious as they awaited additional stimulus measures from the Chinese government following data that showed the country’s economy barely grew in the second quarter. Concerns over the impact of regulatory measures on certain sectors, such as technology and education, also weighed on investor sentiment.

Hong Kong’s Hang Seng index was the worst-performing Asian index for the second consecutive day, sliding by 1.5%. Investors took profits in major technology stocks, leading to the decline. Companies such as Baidu Inc, Alibaba Group, and Tencent Holdings Ltd experienced declines of 1.8% to 4.4% after a strong run in the past week. The profit-taking was partly driven by concerns over the regulatory environment and the overall outlook for the Chinese economy.

While Asian markets displayed mixed performances, the speculation surrounding the Federal Reserve’s rate hike cycle and its potential end drove investor sentiment. The upcoming 25 basis point hike by the Fed in end-July is anticipated to be its last for the time being. Investors will closely monitor further developments in monetary policy and economic indicators to navigate the evolving market conditions.

Get the latest Crypto & Blockchain News in your inbox.