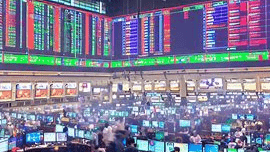

In the face of market uncertainties, the recent S&P 500 earnings report has offered a glimmer of hope for investors. As second-quarter results pour in, the forecast is showing signs of improvement, with more companies surpassing analysts’ expectations.

As the backbone of the American stock market, the S&P 500 is a significant indicator of the nation’s economic health. Second-quarter earnings for its constituent companies are now estimated to have fallen by 6.4% year over year. While still negative, this forecast is an improvement from the 7.9% drop estimated just a week ago.

The current estimate is based on the financial reports from 254 of the S&P 500 companies, with projections made for the remaining components. Notably, approximately 79% of these reports are beating analysts’ expectations, providing a positive boost amidst the overall weak forecast.

Tim Ghriskey, a senior portfolio strategist, commented on the mixed results but highlighted that many high-profile companies have reported better-than-expected earnings, contributing to the recent improvement in the overall forecast.

One notable example of a positive earnings report comes from Alphabet (NASDAQ:GOOGL), the parent company of Google. The tech giant’s second-quarter profit exceeded Wall Street expectations, adding to the positive sentiment in the market.

Historically, an improvement in the earnings forecast often follows stronger-than-expected results reported by companies. For instance, in the first quarter of 2023, year-over-year earnings actually rose by 0.1%, which was significantly better than the initial forecast of a 5.1% drop at the start of the reporting season.

Despite the still-weak earnings picture, stock prices have been rising, partly due to the expectations that the Federal Reserve may be nearing the end of its rate-hiking cycle. This optimism has fueled the S&P 500 index to achieve its highest close since April 2022.

However, investors are keeping a watchful eye on market developments, as uncertainties continue to loom. While positive surprises in earnings reports have provided some support to market sentiment, the overall economic outlook remains uncertain.

As the earnings season progresses, investors and analysts alike are closely monitoring the financial performance of companies and the actions of the Federal Reserve. Any indication of potential economic shifts could significantly impact market trends.

The second quarter of 2023 witnessed a resurgence in economic activity as the global economy began its recovery from the pandemic-induced recession. This recovery was accompanied by a surge in consumer spending, corporate earnings, and improved business sentiment. Despite these positive indicators, concerns lingered around inflationary pressures, supply chain disruptions, and ongoing geopolitical uncertainties.

During this period, companies in the S&P 500 faced several challenges while navigating the dynamic economic landscape. Many businesses reported supply chain disruptions, labor shortages, and increased raw material costs, impacting their bottom lines. The volatility in commodity prices and energy markets also contributed to the mixed performance of some firms.

The technology sector, which had been a major driver of the market rally in recent years, faced its own set of hurdles. While some tech companies experienced robust growth, others grappled with increased regulatory scrutiny and concerns over data privacy.

On the other hand, traditional industries like finance, healthcare, and consumer goods showcased resilience and adaptability during the recovery phase. Companies that provided essential services and products were among those that fared relatively well.

It’s worth noting that amid the challenges, companies also found opportunities for growth and innovation. The acceleration of digital transformation and the rise of ESG (Environmental, Social, and Governance) investing became prominent themes. Many businesses focused on sustainability, diversity and inclusion, and responsible business practices to appeal to socially conscious investors.

Moreover, the growing interest in cryptocurrencies and blockchain technology provided new avenues for companies seeking to diversify and explore emerging markets.

The Federal Reserve’s monetary policy remained a key influencer of the market’s trajectory. Investors closely monitored the central bank’s actions, hoping for signs of tapering the bond-buying program and potential rate hikes. Speculation around these decisions played a crucial role in shaping investor sentiment and market volatility.

As companies released their earnings reports, investors keenly analyzed their financial health, future outlook, and ability to navigate the evolving economic landscape. Positive surprises from high-profile companies like Alphabet demonstrated resilience and offered confidence to the market.

Looking ahead, the S&P 500 earnings report and the market’s performance will continue to be closely watched. Factors such as geopolitical developments, inflation trends, and the Federal Reserve’s actions will play a pivotal role in shaping the market’s trajectory.

As always, investors are encouraged to exercise caution and consider their risk tolerance before making investment decisions. In times of uncertainty, diversification and long-term investment strategies can help weather market fluctuations.

In conclusion, the latest S&P 500 earnings report offers a glimmer of hope amidst market uncertainty. Second-quarter results have shown signs of improvement, with many companies exceeding expectations. Investors remain vigilant as they navigate the fluctuating market conditions, keeping a close eye on company reports and economic indicators for further insights.

Get the latest Crypto & Blockchain News in your inbox.